Inside This Issue

· Varieties of Anxieties: Corporate America Showing Signs of Unease

· Grows Great, Less Fulfilling: For Ferromex, Volumes Up but Profits Down

· Steel’s Good: U.S. Steel Sector Cheers New Tariffs

· Car Sick: U.S. Auto Sector Warns of Tariff Doom

· Peace of Mine: Optimism on Coal Amid New Policies, Need for More Power

· Construction Obstruction: STB’s Fuchs Laments Onerous Environmental Reviews

· Hey You, Time to Renew: Wabtec Highlights Aging of N. America’s Locos

· Rolling Stock Market: Greenbrier Makes Case for Railcars as an Investment

Track Talk

“It’s my view, that as a general matter, the environmental process has gotten out of hand.”

- STB chair Patrick Fuchs, speaking with Byron Porter of “The Pacific”

Read American Places, a book with deep insights into the most important trends and developments throughout the U.S. economy -Jay Shabat, Publisher, Railroad Weekly

The Latest

· A sense of anxiety is building across Corporate America—anxiety about reawakening inflation, anxiety about labor shortages, anxiety about interest rates, and anxiety about federal policies, most importantly tariff policies. To be clear, the U.S. economy remains strong (as discussed in some detail below). Companies, meanwhile, welcome Washington’s more business-friendly approach to regulation, energy production, and taxes. Executives are expressing their hopes and fears, which vary from Ford Motor’s dire warnings about tariffs to Peabody’s enthusiasm for a new presidential administration that’s “vocally pro-coal.” The steelmaker Nucor, thrilled at new steel tariffs, said unequivocally, “Unfairly traded imports continue to be a challenge for the domestic steel industry, with earnings negatively affected by rising global steel overcapacity and surges of unfairly traded imports, including corrosion-resistant steel. More needs to be done to ensure that these illegally dumped and subsidized imports do not continue to distort the American market and erode profitability.”

· But how do U.S. railroads feel? It’s been a few weeks now since UP, CSX, and NS presented and discussed their Q4 earnings. This week in Miami, at a Barclays investor event, they’ll have a chance to update their thoughts. Railroads are surely happy about new leadership at the FRA, about the potential revival of coal demand, and about the large manufacturing and infrastructure investments still for now moving forward across the country. They’re surely concerned though, about what tariffs might do to some of their most important customers, i.e. those in the auto, agriculture, and energy sectors. What about the future of federal support for electric vehicle factories, semiconductor plants, biofuel production, and infrastructure?

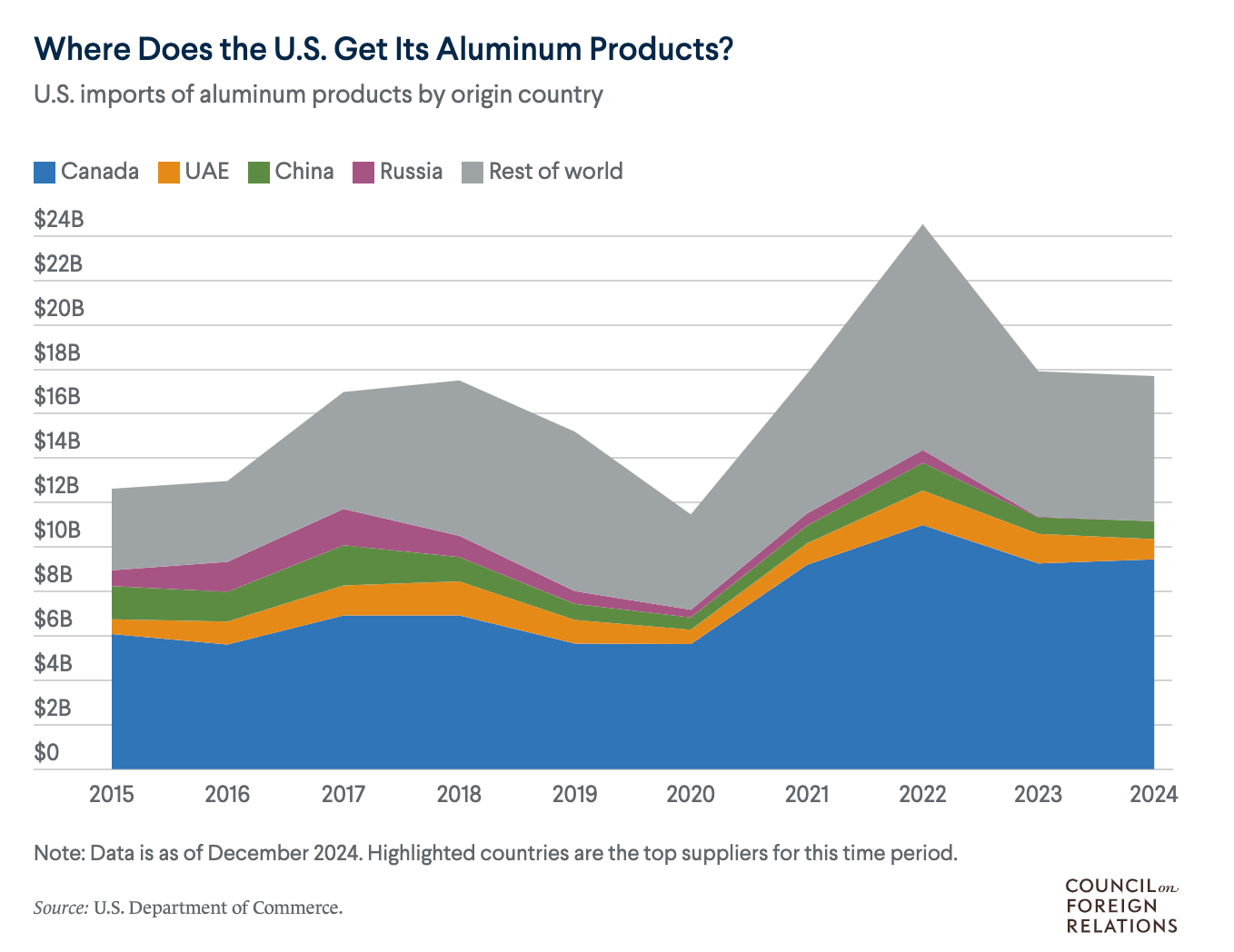

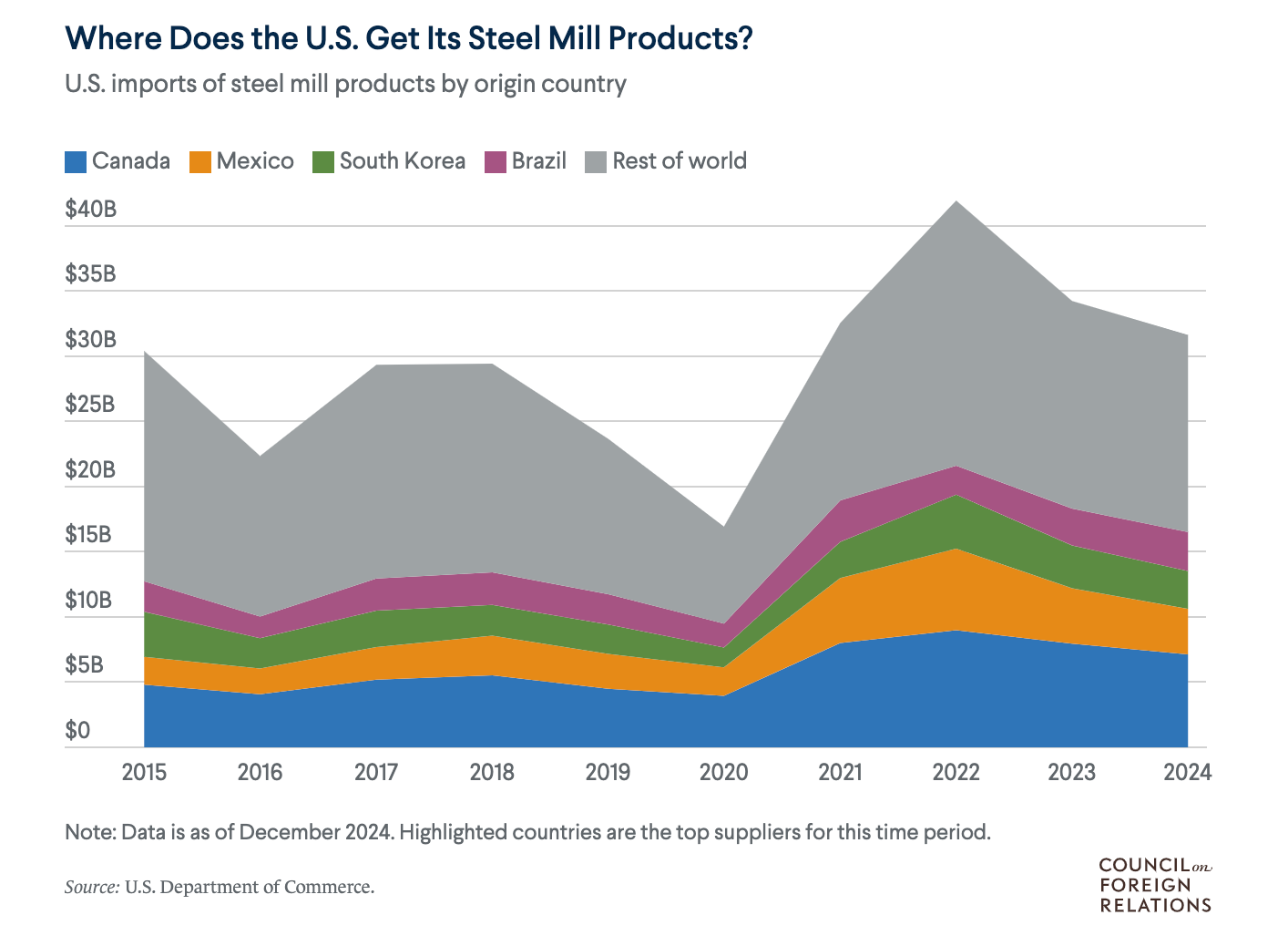

· Canadian National and CPKC will speak at the Barclays event as well. CPKC is also scheduled to address a Citi conference, also in Miami. Canadian railroads, of course, face even greater peril from U.S. tariffs, specifically the blanket 25% imposition on nearly all Canadian imports, originally scheduled to take effect Feb. 4th but postponed by a month. Will it be postponed again? If not, Canada’s economy stands to suffer greatly. Washington last week separately imposed a 25% tariff on all foreign steel and aluminum. Big steel users include construction firms and auto producers. Aluminum is used for products ranging from Coca-Cola cans to Boeing airplanes.

· As for Mexico’s railroads, Ferromex reported its Q4 earnings last week (see below).

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.