Inside This Issue

· Union Terrific: Ra Ra for Omaha as UP Profits Shine

· Union Acidic: Key NS Labor Groups Blast Execs; Now Back Ancora

· Yearnings for Better Earnings: Weak Q1 Margins Put NS on Defensive

· Shiny Happy People: CN Feeling Good About Demand, Economy

· Electric Revenue: CPKC Alone In Growing Sales; “And Then We’ll Take It Higher”

· Declines from the Mines: RR Coal Concerns Deepen

· Golden State Debate: RRs Urge Feds to Reject California Loco Regs

· Prepare for a New Chair: STB’s Oberman Retiring on May 10th

Track Talk

“Our volume outlook in some markets continues to be challenged. We are mitigating those challenges by driving efficiency in the network… There’s certainly more to do, but we’re on the right path.”

-Union Pacific CEO Jim Vena

The Latest

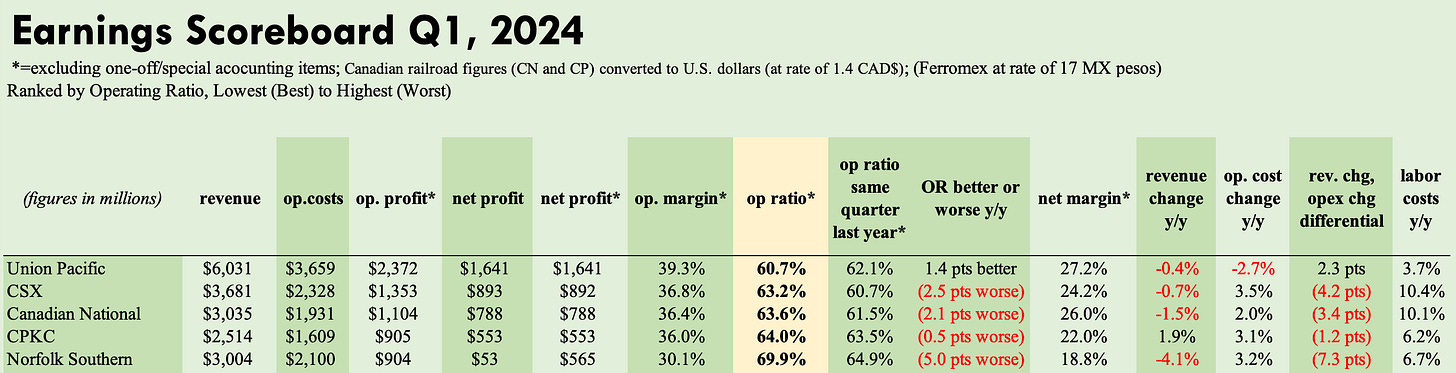

· All five publicly-traded U.S. and Canadian railroads have now reported their first quarter financial results (privately-held BNSF and Mexico’s Ferromex are still to come). The standout performer was unequivocally Union Pacific, the only Class I that had a better operating ratio this Q1 than last. As you’ll read below, UP wasn’t immune to a slumping coal market and ongoing weakness in domestic intermodal pricing. But other areas of the business did well, and the railroad achieved significant productivity and efficiency gains. Investors loved it, sending UP’s stock price up by almost 5% last week, even as all other railroad stocks lost value. The two Canadian carriers generally did well financially last quarter, with CN expressing greater optimism and CPKC successfully harvesting merger synergies to grow revenue. Norfolk Southern again reported the ugliest numbers, which may or may not cost Alan Shaw and his team their jobs—two key unions are now supporting their ouster. Shaw’s new lieutenant John Orr will again be out on the campaign trail this week, holding a “fireside chat” with UBS analyst Tom Wadewitz on Monday.

· Wabtec’s Q1 earnings call featured much discussion about the future of locomotive technology. For now, North America’s major railroads are largely upgrading and modernizing their existing locomotives, unsure about what the next-generation will look like. They’re also turning to current-generation models for their replacement needs. At some point though, a new wave of lower-emission locomotives will enter the scene. And exactly what they look like—and exactly when that happens—will be in part shaped by government regulations. Wabtec and the rest of the North American rail sector are watching with interest and in some cases trepidation as the state of California and its Air Resources Board move forward with a plan to very aggressively force usage of zero-emission locomotives. Wabtec is preparing by developing heavy haul locomotives powered by hydrogen fuel cells. In addition, it will soon ship its first battery-hybrid model. “We’re technically very well positioned here to support customers for all outcomes,” said Wabtec’s CEO Rafael Santana. “We’ve got the best-in-class products. We’ve got the lowest emissions, the lowest fuel consumption, best reliability, [and] ultimately best availability, and value for customers.” He notes that the federal EPA recently defined what “zero emissions” means, in a way that makes it somewhat easier for railroads to get there. The EPA will ultimately be the arbiter of whether California can proceed with its new regulation (see below). More generally Wabtec says it, “continue[s] to see significant opportunities across the globe in demand for new locomotives, modernizations, and digital technologies as our customers invest in solutions that continue to drive reliability, productivity, safety, and fuel efficiency.” Last quarter, by the way, the active locomotive fleet in North America declined a bit y/y even as carload volumes increased 2%.

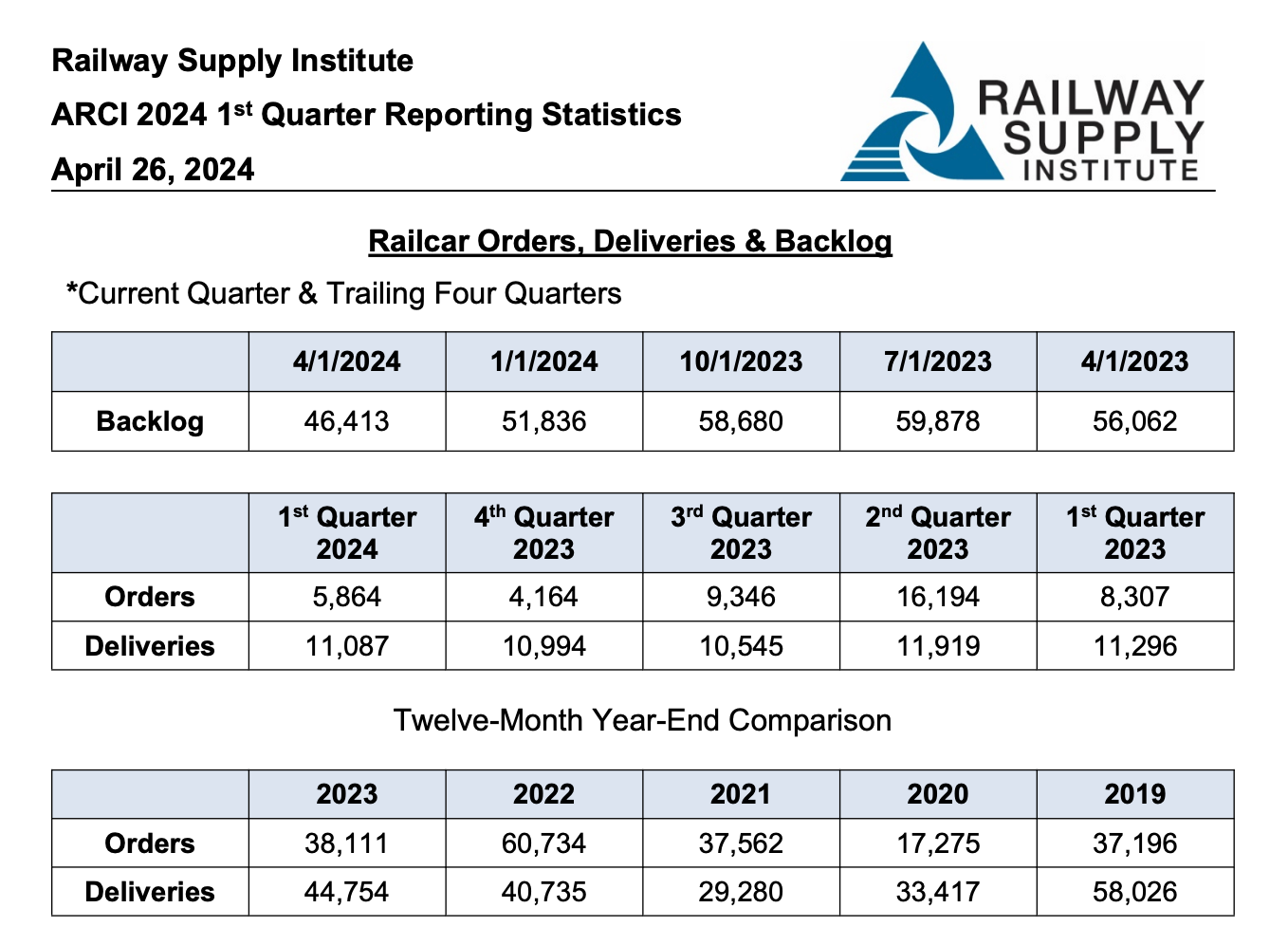

· In the railcar market, Wabtec happened to mention that industry analysts now expect about 36,000 railcar deliveries in 2024. Not long ago, the expected figure was 38,000 (for context note the RSI data below). In any case, the railcar lessor GATX, in its earnings call, said demand remains strong, with customers renewing at a high rate—and at high rates. “Additionally, we continue to successfully place new railcars from our committed supply agreements with a diverse customer base.” GATX has found customers for all 12,000-plus railcars that it ordered from Trinity and Greenbrier in 2018. It’s placed some 3,600 of the 15,000 railcars it ordered from Trinity in 2022.

· In other news, STB chair Marty Oberman set May 10th for his retirement. President Biden must now appoint his successor. Will it be another incumbent Board member? Oberman has been STB chairman since 2021 and a Board member since 2019. Separately, as Wabtec mentioned, debate continues over California’s proposed new locomotive regulations, which would ban older locomotives (beginning in 2030) that do not meet specific emission standards. And All new locomotives with engines built after 2030 would have to be zero emission. Railroads and others want the Federal Environmental Protection Agency (EPA) to reject California’s move. The AAR, however, does note that the EPA is “not obligated to rule on [California’s] authorization request and is not bound by a deadline.” Also, the rail community was saddened by the passing of New Jersey Congressman Donald Payne Jr., the leading Democrat on the House Subcommittee that oversees rail transport.

The Economy

· The U.S. Bureau of Economic Analysis said inflation-adjusted GDP grew last quarter by an annualized 1.6%. That marks a slowdown from the 3.4% growth recorded in Q4 (though the figure will be revised twice over the coming months). It was the slowest recorded growth, in fact, since GDP statistically contracted in the first half of 2022. The BEA ascribed the Q1 slowdown to decelerations in consumer spending, exports, and state and local government spending, and a downturn in federal government spending. There were some negative changes in inventories and international trade as well, which can be volatile. More positively, consumer spending overall, especially on services like health care and insurance, stayed strong, as did business spending on software investments, for example (Silicon Valley is plowing huge sums of money into the development of artificial intelligence models). Even investment in new residential housing was positive. A separate BEA report noted that consumer price inflation, measured by the PCE index, rose 2.7% y/y during March. It’s another reason why markets have all but given up hope that the Fed will cut interest rates anytime soon.

· Based on its survey of purchasing managers, S&P Global observed that “U.S. business activity continued to increase in April, but the rate of expansion slowed amid signs of weaker demand… Slower increases in activity were recorded across both the manufacturing and services sectors.”

· In general, though, the U.S. economy stands on firm ground with both job markets and corporate earnings in good health. Put another way, the corporate and household sectors are broadly faring well, at least relative to how they would during a recession. We’ll see if the new S&P Global report heralds an unwelcome change. Note that Atlanta’s GDP Now forecaster sees Q2 GDP growing a robust 3.9%. But also keep in mind that its Q1 estimate was more than a point above what the BEA’s official figure showed last week. We’ll see if the BEA figure gets revised upward.

Q1 Earnings: Norfolk Southern

· No surprises here. As previewed two weeks earlier, Norfolk Southern registered a 70% operating ratio in the January-to March quarter, excluding special items. This was a distressing five points worse than what it managed in last year’s first quarter. And it reflected a 4% y/y drop in revenues, combined with a 3% increase in costs. Ever since the end of the pandemic, NS has consistently produced the worst profit margin of all the publicly-traded North American Class Is (UP, CSX, CN, CPKC). It’s perhaps also unsurprising then, that it would be the target of an activist investor, convinced that there’s a better way to run the company.

· Ancora’s efforts to seize control of the NS Board received an important burst of momentum with the endorsement of two key labor unions: the Brotherhood of Locomotive Engineers (BLET) and the International Brotherhood of Teamsters’ Trainmen Division (BMWED-IBT). The latter, for its part, stated, “The BMWED-IBT, after more than a year of non-committal hedging on reasonable, needed changes and untenable shakiness in management at Norfolk Southern, has determined that a change in leadership is needed for the freight rail carrier and its employees.” Other unions including the SMART-TD—this is the railroad’s largest union—maintain their support for Shaw and the incumbent NS Board. Shareholders will vote on which slate of Board directors to choose on May 9th.

· During the NS earnings call, CEO Alan Shaw and his new COO John Orr emphasized their many initiatives to quickly improve the company’s financial performance. “Everything is on the table,” said Orr. “Everything is being scrutinized.” Their ultimate goal is to lower operating ratio by four points already in the second half of this year. By the next three to four years, they’re promising an O.R. below 60%. “We will do it at a safe, sustainable manner that recognizes our current operating environment and brings key constituents, including our shareholders, customers, employees, and regulators along with us on our mission.”

· Like other railroads, NS saw its Q1 revenues decline in part because of lower fuel surcharges, which affected its intermodal, merchandise, and coal businesses. “Overall, fuel surcharge revenue was the single largest headwind in the quarter, declining by $115 million.”

· But it wasn’t the only headwind. Intermodal pricing remained weak, specifically in the non-premium domestic market. And even internationally, revenue per unit declined because NS shipped many more empty containers. With ocean journey times up due to various disruptions, maritime shippers are incentivized “to deploy their capacity back on the water as soon as possible, which increases the need to reposition empty containers back to the ports.” Remember that NS depends more on the intermodal market than most of its peers, with the segment accounting for a quarter of it Q1 revenues. The heavy exposure to this lower margin business is one reason why the company tends to produce higher operating ratios. But nobody right now—not Ancora and not current management—accepts this as an excuse.

· The important coal business also faces headwinds. The financial impact of the Baltimore port closure, which limits coal exports, will amount to some $25m to $30m a month. Overall coal volumes, meanwhile, “will be challenged as high stockpiles and low natural gas prices reduce utility shipments.” In addition, seaborne coal prices weakened significantly throughout the quarter, meaning less revenue for railroads.

· Coal and intermodal aside, the broader NS merchandise business enjoyed solid pricing gains, excluding fuel surcharges. “Overall pricing and volume increases in our metals franchise were boosted by improved network fluidity from increased car velocity. That same velocity and fluidity helped volumes in automotive remain flat “despite manufacturing headwinds at several of the plants that we serve.”

· Management pointed to the ongoing boom in infrastructure projects across the NS network. It also highlighted its recent decision to buy a transload and warehouse facility in Chicago. It’s restructuring its Triple Crown service for first and last mile delivery. It’s cutting underperforming intermodal lanes. And it reminds investors that despite the current intermodal pricing headwinds, “intermodal volumes are increasing as international trade remains robust.”

· As for the macroeconomic outlook, it’s still a “mixed bag” with a lot of uncertainty regarding everything from inflation to Fed policy. Recent signs of a manufacturing recovery are encouraging. And NS says improved service will help it win new business even if the freight economy remains muted.

· In summary, Shaw says his team is committed to “mirror the great success stories of the Canadian railroads who have recognized that PSR is about more than tearing a railroad down to its studs at slashing costs regardless of the fallout.” In mentioning the phrase “tearing a railroad down to its studs,” he was invoking a comment by Ancora’s proposed operating chief Jamie Boychuk. “We’re not tearing this thing down to the studs. John [Orr] knows how to do it without tearing it down to the studs as the activist COO has said he would have to do.”

· One final note about staffing. NS plans for total headcount to be down around 2% by the end of this year. That will mostly happen through attrition.

Q1 Earnings: Union Pacific

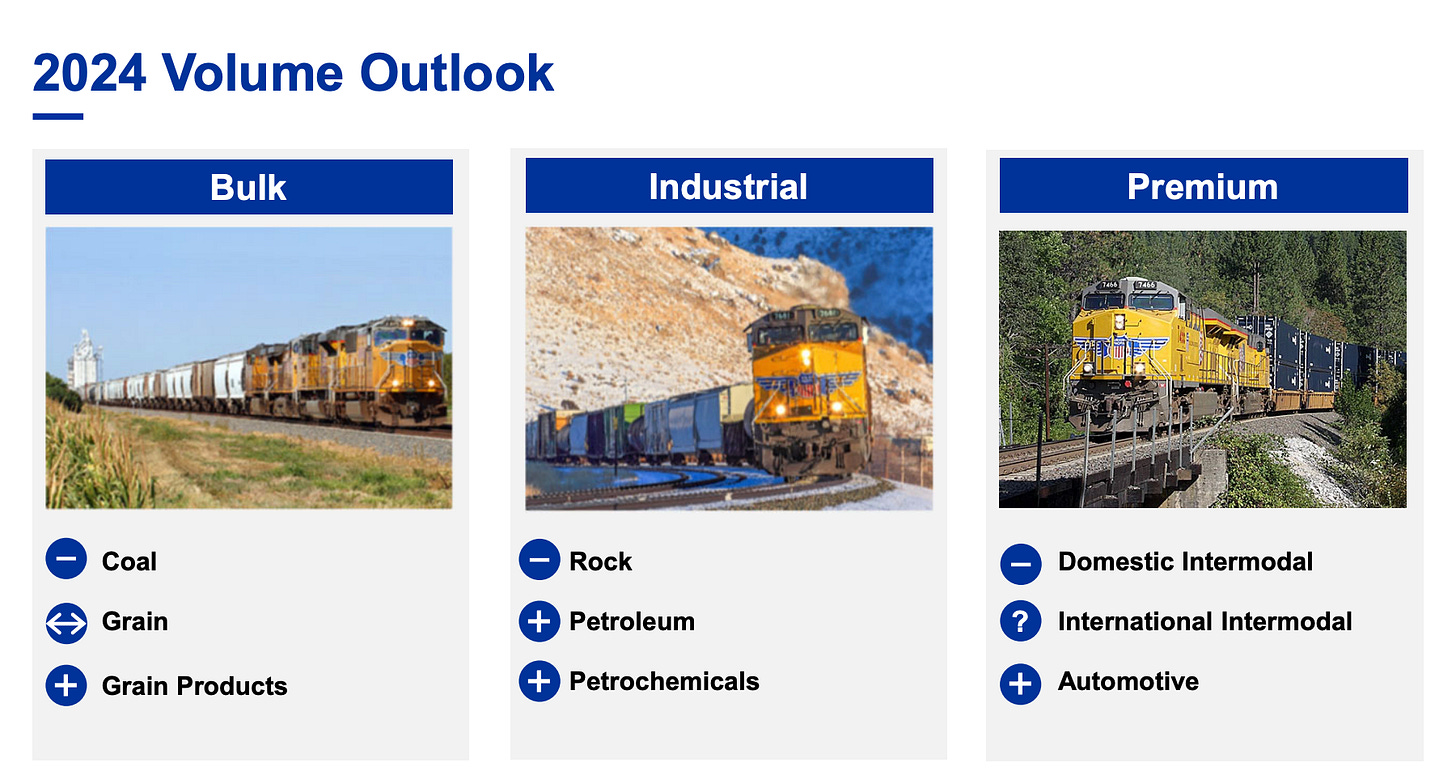

· The story is very different at Union Pacific. While NS and other Class Is had a tougher first quarter this year than last, UP was alone in improving its operating ratio. It didn’t quite get below 60%. But at 60.7%, it came pretty darn close. The company saw just a slight y/y revenue decline, despite headwinds like lower fuel surcharges, the loss of a major intermodal contract, an 18% drop in coal volumes, and a soft overall freight economy. Operating costs, meanwhile, dropped almost 3%, despite more expensive labor contracts. Lower fuel prices helped on the cost side (though fuel surcharges fell to a greater degree). Most encouragingly, UP made impressive productivity gains, through measures like removing about 500 locomotives from active service. CEO Jim Vena and his team now say, “[The] profitability outlook [is] gaining momentum with strong service product, improving network efficiency, and solid pricing.”

· Operations are running well. Pricing trends were favorable. And if you exclude coal, UP’s total volumes were actually up y/y by about 2%. That’s pretty good considering economic conditions in the industrial and logistics realms. Management mentioned an increase in soda ash and petroleum shipments which boosted revenue per unit.

· Grain revenues were flat y/y, on 4% more volume—UP shipped more corn both to Mexico and from Canada. Fertilizer and food revenues were each up by 8%. Chemicals/plastics, energy, auto, and forest products all saw gains as well. In the auto space, UP won some new business from Volkswagen and General Motors. Besides coal, the only major categories to see revenue decline were intermodal and metals/minerals. The latter was impacted by lower rock volumes due to challenges with high inventories and bad January weather. Rock is used in construction, and construction was exceptionally strong last year, making for tough y/y comparisons.

· Intermodal volumes were boosted by strong international west coast demand, partially offsetting the loss of a major international contract. Domestic intermodal conditions were “soft.”

· Looking ahead, UP doesn’t sound too optimistic about coal, with natural gas prices low. It expects “stable” grain demand as it keeps close tabs on the latest crop conditions and fourth quarter export demand. Importantly, shipping biofuel feedstocks should help grow the grain business. It’s bullish on the petroleum and petrochemical markets in the Gulf region. It’s no less bullish on Mexico, working with Ferromex and Canadian National. In addition, “there are ample opportunities ahead for us to further improve asset utilization and the efficiency of our network.”

· For now, “Our overall outlook on the freight environment hasn't changed a lot since January.” UP is surely watching developments like the labor negotiations at east coast ports, which could lead to busier west coast ports. UP will have a lot more to say in September, when it plans an investor day event.

Q1 Earnings: Canadian National

· Losing a takeover battle is never fun. But Canadian National has done fine on its own since losing the battle to buy Kansas City Southern in 2021. In 2022, under new CEO Tracy Robinson, CN achieved a sub-60% operating ratio. In 2023, it led all Class I railroads with an O.R. just above 60%. Now, 2024 is off to a promising start, with “volumes… on the upswing” and “momentum building.” Rival Canadian Pacific may have won the KCS war, but CP is cultivating an impressive set of organic growth opportunities. What’s more, management said the “broad economy in 2024 will be more constructive than last year,” with positive industrial production growth and interest rates stabilizing.

· CN’s first quarter operating ratio did worsen y/y, rising to just under 64%. Operating costs increased 2%, driven almost entirely by a 10% jump in labor costs. Revenues, meanwhile, declined almost 2%, partly because of lower fuel surcharges that accompanied lower fuel prices. The offset wasn’t total though—surcharge revenue declined by about $121m but fuel costs declined only $21 (all figures here are converted to U.S. dollars). More significantly, intermodal pricing remained weak, a universal reality for all the Class Is.

· More specifically regarding the intermodal market, imports into Canada’s west coast ports—namely Vancouver and Prince Rupert—are recovering nicely from last summer’s labor strike. This helped CN’s international container volumes increase 5% y/y last quarter, despite a decline in the east (i.e., Halifax and Montreal). Domestic intermodal volumes, however, declined 3% due to North America’s trucking overcapacity. CN is expecting a domestic recovery, but it’s not clear when

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.