Inside This Issue

· Tariff Talk: Trump Threatens Trade War with Neighbors

· Making Canada Great Again: RAC Calls for RR-Friendly Reforms

· Not Again: Now, the Unifor Union is Threatening to Strike (CPKC)

· Be a Bigger Man: Manzanillo’s Port Announces Major Expansion

· Haul of the Wild: Florida’s Unique Intermodal Economics

· Fuel of the Future? CPKC Advances Hydrogen Efforts

· Hill of Fame: The Legacy of RR Builder James J. Hill

· Palm Beach Speech: RR Execs to Present at UBS Event in Florida

Publisher’s Note: As a reminder, Railroad Weekly publishes 48 out of the 52 weeks per year. Our last issue for 2024 will be December 16th. The first issue of 2025 will be on January 6th.

For a holiday gift idea, please consider my book, American Places. It’s an easy-to-read profile of more than 70 U.S. cities, counties, and towns across the U.S., explaining what drives their economies. It’s designed to provide a greater sense of understanding about how the U.S. economy functions overall, and what makes it strong in some ways and challenged in others. Click here to buy on Amazon:

Read American Places, a book with deep insights into the most important trends and developments throughout the U.S. economy -Jay Shabat, Publisher, Railroad Weekly

Track Talk

“Canada’s strength as a trading nation and destination country is rooted in the strength of our supply chains, and rail plays a pivotal role in ensuring we remain a competitive and reliable partner.”

- Railway Association of Canada president Marc Brazeau

The Latest

· As railroads like to say, railroading is a 24-7 outdoor sport, 365 days a year. Yes, some things need to move even on holidays like Thanksgiving. But volumes were lighter last week as Americans ate their turkeys. BNSF for one advised that lighter volumes through Wednesday of this week would likely mean more train consolidations, which in turn could cause delays of up to 48 hours. It also noted reduced schedules by shortlines, possibly delaying interline traffic. Last year, for the record, U.S. carload volumes dropped by about 18% during the week of Thanksgiving, according to AAR data.

· It was business as usual north of the U.S. border, where the Railway Association of Canada (RAC) hosted an industry event (see below). A major theme, unsurprisingly, was ensuring future supply chain stability amid an epidemic of labor unrest throughout the transport sector. Just last week (also discussed below), another union threatened to strike CPKC. Of course, tariffs too were an all-consuming topic of conversation across Canada last week, following U.S. threats to effectively crush the Canadian economy with exorbitant tariffs. The threats were directed toward Mexico as well.

· A correction (and an apology): In last week’s issue, we referred to a UBS investor event in Florida. We mistakenly said this was taking place last week. It’s in fact this week; Stay tuned for highlights in next week’s Railroad Weekly. CPKC’s chief Keith Creel, Union Pacific’s chief Jim Vena, and CSX’s CFO Sean Pelkey are among the scheduled speakers. Separately, the locomotive builder Wabtec will be presenting at a Goldman Sachs Industrials and Materials Conference on Wednesday.

· Back on the tariff topic, it’s now top of mind for many North American railroads. That’s after a social media post by U.S. President-elect Donald Trump that read: “On January 20th, as one of my many first Executive Orders, I will sign all necessary documents to charge Mexico and Canada a 25% Tariff on ALL products coming into the United States...” Trump subsequently spoke with the leaders of both Mexico and Canada, seemingly (though without clarity) diffusing the tension somewhat. Canada’s Prime Minster Justin Trudeau—alarmed by the dire economic implications—quickly flew to Mar-a-Lago to discuss the matter in person. Mar-a-Lago, by the way, is in Palm Beach, Florida, the site of this week’s UBS conference. Maybe the railroad execs can stop by Trump’s residence for an industry chat.

In Other Developments…

· Mexico’s busiest container port—in Manzanillo on the Pacific coast—announced a major expansion, to more than double its TEU capacity by 2030. According to The Maritime Executive, “Road and rail capacity issues have limited throughput at Manzanillo, and Mexico’s thriving manufacturing sector has been pushing for more investment in infrastructure to modernize the facility.” The expansion could have negative implications for CPKC’s ambitions at Lazaro Cardenas port, which has benefitted from Manzanillo’s congestion. Then again, if Mexico’s international trade volumes grow as hoped, all major ports stand to benefit. This potential growth, however, depends on Mexico expanding its role in the supply chains of U.S. companies, which a tariff war could undermine.

· Back in Canada, Cando Rail & Terminals added another multi-purpose rail terminal to its network. That’s after buying a railcar storage and transload terminal in the Northwest Territories. Cando is one of North America’s largest owners and operators of first- and last-mile rail infrastructure. It also owns the Central Manitoba Railway (CEMR), a 67-mile shortline serving more than 20 customers in the Winnipeg area.

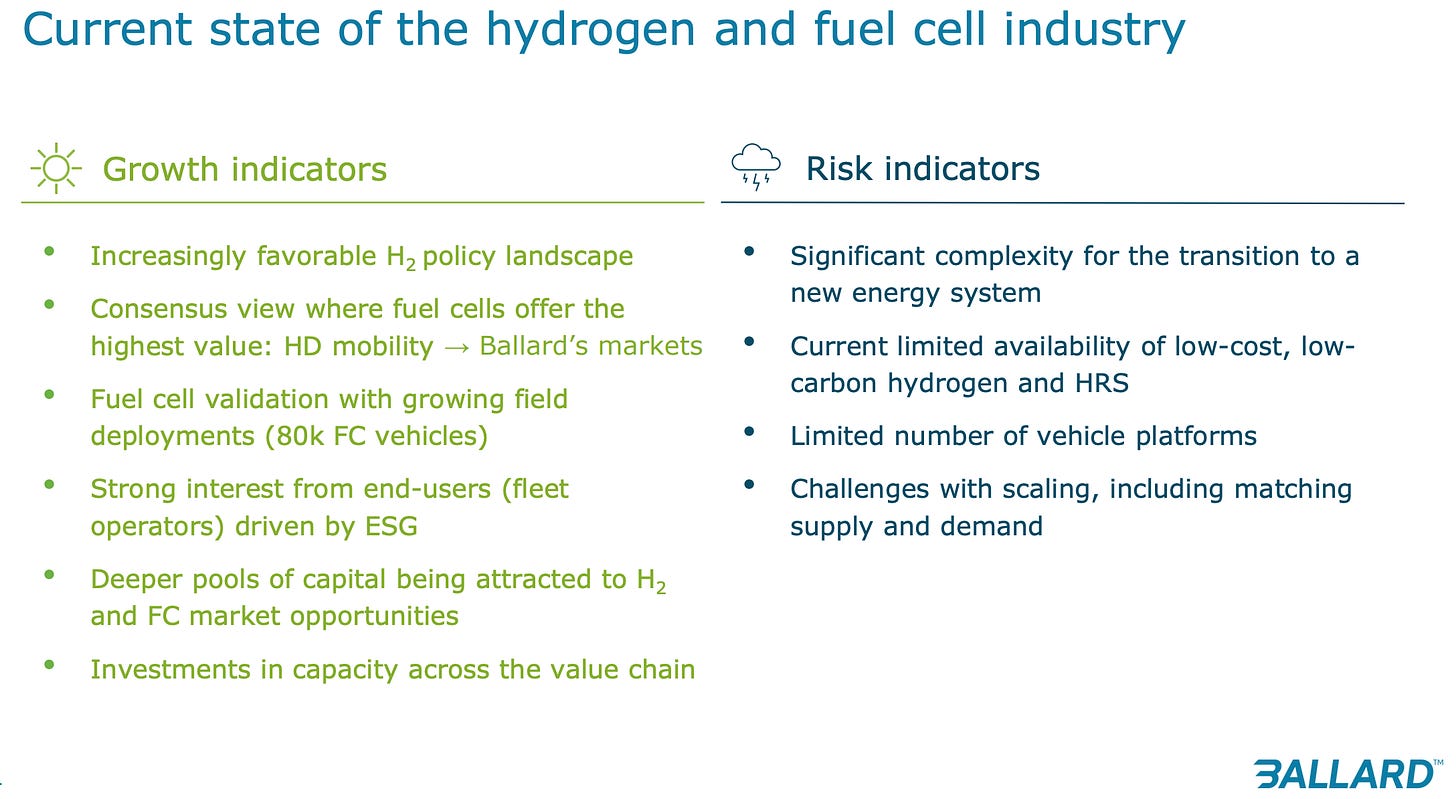

· On the sustainability front, CPKC announced the completion of new hydrogen projects with the utility company ATCO EnPower. They’ll enable on-site hydrogen production and refueling in Calgary and Edmonton, supporting the railroad’s retrofit of some diesel locomotives with hydrogen fuel cells. CPKC hopes this will be a model for more such facilities throughout Canada, perhaps ushering in a future of zero-emission trains. For now, though, hydrogen power remains significantly more expensive than traditional diesel fuel—even more so with diesel prices declining in recent months. CPKC, by the way, is co-developing hydrogen locomotives with CSX. BNSF, meanwhile, is pursuing the technology with Chevron and Caterpillar’s Progress Rail. Wabtec is likewise investing in the technology, also with U.S. federal money allocated from Washington’s infrastructure bill. Its chief Rafael Santana said earlier this year, “We’re progressing here on really making sure hydrogen is also a part of that [zero emissions] solution.” But he also cautioned that full hydrogen solutions “are much farther out in terms of the opportunity to adopt, in terms of the maturity of the technology, and in terms of the economics that it needs to get to.”

courtesy: CPKC

courtesy: Ballard

· Now to the labor front, where CPKC faces yet ANOTHER strike threat. Unifor, the union representing about 1,200 CPKC workers including mechanics, said, “Negotiations between Unifor and CPKC have reached an impasse.” Their deadline to reach a deal is January 28th.

· BNSF says its prized southern transcon line—this connects Los Angeles with Chicago—is now essentially all double tracked or better. That’s after completion of a second line near Kansas City, leaving just two tiny sections of single track left. “Our Southern Transcon is now almost completely double-, triple- or quadruple-tracked. We can now run multiple priority intermodal trains in and out of Southern California daily between key markets, with no need to stop a train every 10 miles to meet another throughout the trip.” BNSF moves more intermodal container fleet than any other North American railroad, largely thanks to its southern transcon line.

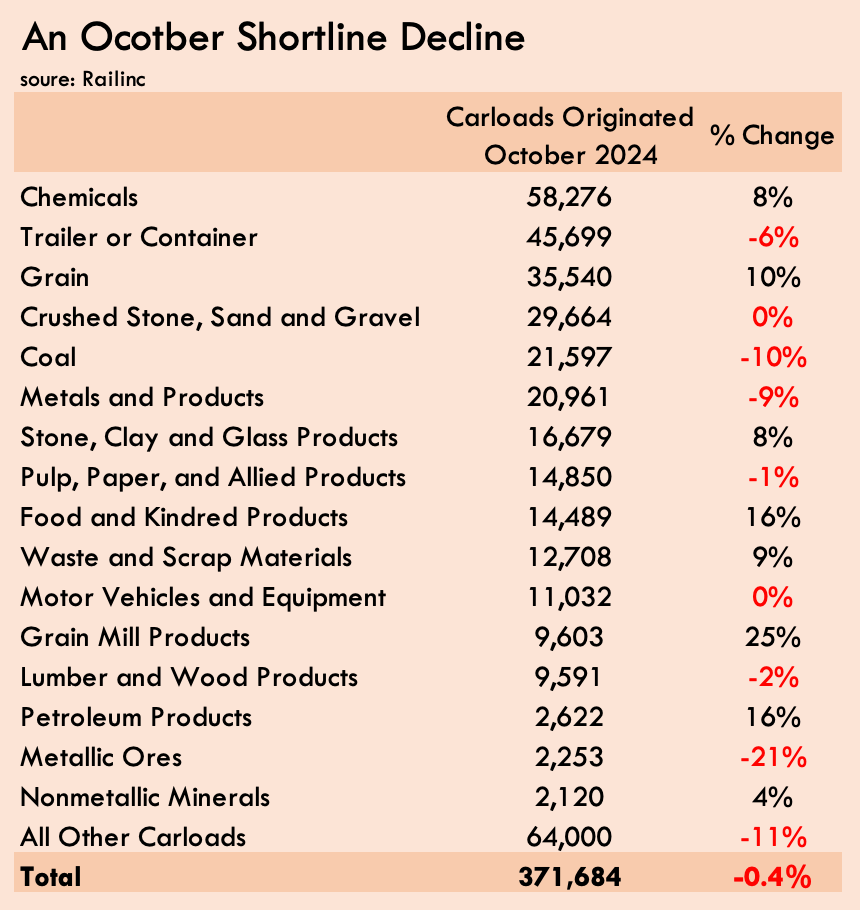

· According to Railinc, which is part of the AAR, shortline railroads saw their traffic volumes shrink slightly y/y in October. But year to date, traffic is still up about 4%.

Above chart based on Railinc data shows number of carloads moved on short line and regional railroads

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.