Surf Board Memories

Railroad Weekly December 1, 2025

Inside This Issue

· Surf Board Memories: A Look Back at the STB’s UP-SP Decision

· Pre-Wedding Waiting: Dec. is Here; Means UP Merger App Near

· Folly Wood: It’s Been a Rough Year for Forestry Markets

· Two Years of Tears: CN Carload Volumes Down from 2023

· Sales of Some Rails? Shortlines Could Benefit if UP and NS Divest

· It’s a Mall World After All: Consumers Must Shop, Lest GDP Drops

· How is Spending Trending? Holiday Peak So Far Looking Good

· This Week: UP and Others to Address Investors in Florida

Track Talk

“We’ve been in a freight recession for the last few years. But eventually, it will turn, and when it will turn, then we will capture that rebound at low incremental cost. I’m looking forward to that.”

-Canadian National CFO Ghislain Houle

The Latest

· Though railroads don’t break for holidays, U.S. executives were quietly eating their turkeys last week, giving thanks for at least some demand growth this year—U.S. rail volumes are up 2% y/y through late November, according to the latest AAR figures. Execs will be back on the road this week, delivering remarks at a UBS investor event in CSX’s home state of Florida. Union Pacific’s Jim Vena will be there, once again trumpeting the virtues of his grand plan to merge with Norfolk Southern. Some welcome the creation of America’s first truly transcontinental railroad. Others are wary. All stakeholders though, are eagerly awaiting UP’s formal STB merger application, which will provide more details about what the combined railroad would look like, and how it plans to enhance competition.

Looking Back: The UP-SP Merger

· The UP-NS merger application could come as early as this week, based on UP’s stated intention to submit it in early December. As the industry waits, let’s go back 30 years, to look at the outcome of UP’s last big merger, with Southern Pacific. On August 6th, 1996, the Surface Transportation Board (STB) issued its decision to approve the UP-SP merger, following roughly one year of review—UP filed its application in November 1995. At the time, the two railroads said their combination would enable new routes for shippers—Oakland to Chicago, for example, and Los Angeles and Chicago. They’d have a fast path from the west coast to the east, via Dallas-Fort Worth and Memphis. It would create the first-ever single-line route between Seattle and Los Angeles. And so on.

· Union Pacific felt compelled to merge following Burlington Northern’s fusion with the Santa Fe in 1995. Southern Pacific, UP argued, faced a bleak future without a merger. In fact, SP tried to merge with Santa Fe in 1986, but that merger was blocked by the STB’s predecessor, the Interstate Commerce Commission (ICC). By the mid-1990s, SP’s finances were highly stressed, forcing it to repeatedly sell off assets just to stay in business. Some of UP’s arguments then, echoed those it’s making today, i.e., promising efficiencies for shippers by eliminating interchanges. But there’s one big difference between then and now: With the Southern Pacific takeover, unlike the Norfolk Southern takeover, UP planned to cut jobs—about 5k in total. The SP deal also involved the abandonment of 17 line segments covering nearly 600 miles. Will UP and NS also propose to abandon pieces of their combined network?

· To mitigate the STB’s concerns about reduced competition, UP pre-negotiated a package of concessions with BNSF, including line sales and trackage rights. These would provide access to allow BN to compete between Seattle and Los Angeles, for one. The latter would have more access to compete between Oakland and Denver, and from various markets from Houston. UP negotiated specific agreements with coalitions of chemical and coal customers as well. These agreements would prove crucial in securing the STB’s approval.

· To be sure, many parties objected to UP merging with SP. They included railroads like Conrail and Kansas City Southern, which demanded UP sell off various lines and assets. The STB wound up rejecting many of these divestiture demands, fearing they’d neutralize too many of the merger’s potential benefits. The Clinton administration’s Justice Department also urged stronger concessions than the STB wound up demanding. The DOJ, among other things, wanted UP to divest one of two parallel routes running from the Gulf Coast to east coast gateways along the Mississippi. It also wanted UP to sell one of its two central corridor routes between California and the Midwest. In addition, the DOJ said UP should have to enable the introduction of a third competitor—besides BNSF—to enter the busy Los Angeles-Chicago route.

· The STB’s final decision to approve the merger certainly included some concessions. They were generally devised to make BNSF a stronger competitor in markets where many shippers would be otherwise left with just one rail provider. BN, for example, was awarded access on equal economic terms to some key UP/SP storage and other facilities serving Gulf Coast plastics manufacturers. The board separately demanded concessions to protect competition across the U.S.-Mexico border, at the time a priority following the adoption NAFTA (the North American Free Trade Agreement). It also imposed a five-year oversight provision, during which UP and BNSF had to periodically file reports showing that “the protective conditions [ascribed by the STB] are in fact working.”

· At the time, the STB had just three members, and all three voted yes. Chairperson Linda Morgan, in her decision, explained her distaste for large-scale divestitures. This remedy doesn’t distinguish between shippers affected and unaffected by the merger, she argued. In addition, requiring divestitures could “lead to more government intrusion, more regulatory oversight, and, ultimately, more litigation… in short, divestiture poses substantial problems of its own.” The trackage rights UP will provide BNSF, by contrast, are a better remedy, which “can replicate SP’s existing competitive presence.”

from Linda Morgan’s merger approval statement:

· Vice Chair J.J. Simmons, an ICC member when it voted to reject the Southern Pacific-Sante Fe merger, explained why the Union Pacific-Southern Pacific merger was different. For one, UP’s negotiated remedies with BNSF and various shipping groups provided meaningful mitigation to competitive harms. In addition, economic conditions had changed—he cited the rapid growth of intermodal shipping, which stood to benefit most from the UP-SP merger. He agreed with Morgan about trackage rights being a better solution than divestitures. He invoked SP’s weak finances as well, which—among other things—made it an “unreliable provider of rail service to the [Defense Department].” SP’s weak state also put its workforce at risk of losing their jobs.

· Member Gus Owen, meanwhile, cited a long history of public policy that encouraged railroad mergers when in the public interest, as defined by the Supreme Court and Congressional law. Owen mentioned the deal’s “widespread labor union support.” He mentioned “substantial operating cost savings.” He mentioned the environmental and safety benefits tied to taking trucks off the highway. And he mentioned how “more efficient, lower-cost railroads… make American industry more competitive in world markets and make American jobs more secure.”

· How did the merger work out? Operationally, it became a poster child for dysfunction, leaving brain scars on a generation of rail shippers, some still in the business today. Strategically and financially, though, it left Union Pacific with a network that today produces industry-leading operating ratios. A crown jewel of today’s UP system is the old Southern Pacific lines into and out of Texas, specifically the chemical-rich Gulf region. That’s a source of abundant high-yielding business. Interestingly, chemical shippers are currently among the most vocal opponents of UP merging with Norfolk Southern.

· BNSF, ahem, has a less charitable view of the merger’s impact, and the conditions the STB imposed. “In the nearly thirty years since the UP/SP merger… UP has engaged in a pattern of obstructive conduct that has diminished those competitive options and has harmed customers by delaying or preventing BNSF from fully replacing the competition that was lost through the UP/SP merger as the Board originally intended.” In fact, BN is now asking the STB to “review the conditions imposed in connection with he UP/SP merger, enforce the obligations UP has refused to abide by, and modify those conditions as necessary to preserve the competition the Board envisioned.”

Other Updates

· Rail consultant Daniel Bostek, in a LinkedIn post, discusses what a UP-NS merger could mean for shortline railroads. The merger could, he writes, present “massive” opportunities for “consolidators” eager to expand their railroad portfolios. As Bostek explains, “the Surface Transportation Board doesn’t just approve or deny deals—it forces competitive concessions.” In other words, the STB could force UP to divest portions of its network. Some of the larger North American shortline operators today include Genesee & Wyoming, Watco, OmniTRAX, RJ Corman, and Patriot Rail. “These are not your grandfather’s short lines. They’re sophisticated logistics companies with deep-pocketed institutional owners who see the UP-NS merger as a once-in-a-generation acquisition opportunity.” UP, Bostek reasons, might itself offer to shed lower-density branch lines that don’t mesh well with the PSR business model. And this could be a “gold mine” for shortline acquirers. Opportunities could include “branch lines serving agricultural, forest products, aggregates, and small industrial customers that Class I carriers consider ‘non-core.’”

excerpted LinkedIn post below:

· Speaking of shortline deals, the investment group Fortress will buy control of two carriers: 1) The Wheeling & Lake Erie Railway (W&LE) and 2) the Akron Barberton Cluster Railway (ABC). With the STB’s approval last week, Fortress now owns eight Class III rail carriers.

· UP and NS are already working together on new options for shippers. They’re now offering domestic container service to Cincinnati from both of UP’s Los Angeles-area terminals, namely City of Industry and IEIT (Inland Empire Intermodal Terminal). Importantly, UP and NS will eliminate a truck transfer in Chicago, going from rubber tire to steel wheel.

Conference Highlights: Canadian National

· Canadians celebrated their Thanksgiving in October. So, Canadian National’s CFO Ghain Houle was out and about last week, addressing a Desjardins investor event in Toronto. As December arrives, CN is gaining back the business it lost during labor unrest at ports last fall. As a result, volumes through the first three weeks of November (RTMs) are up 15% y/y.

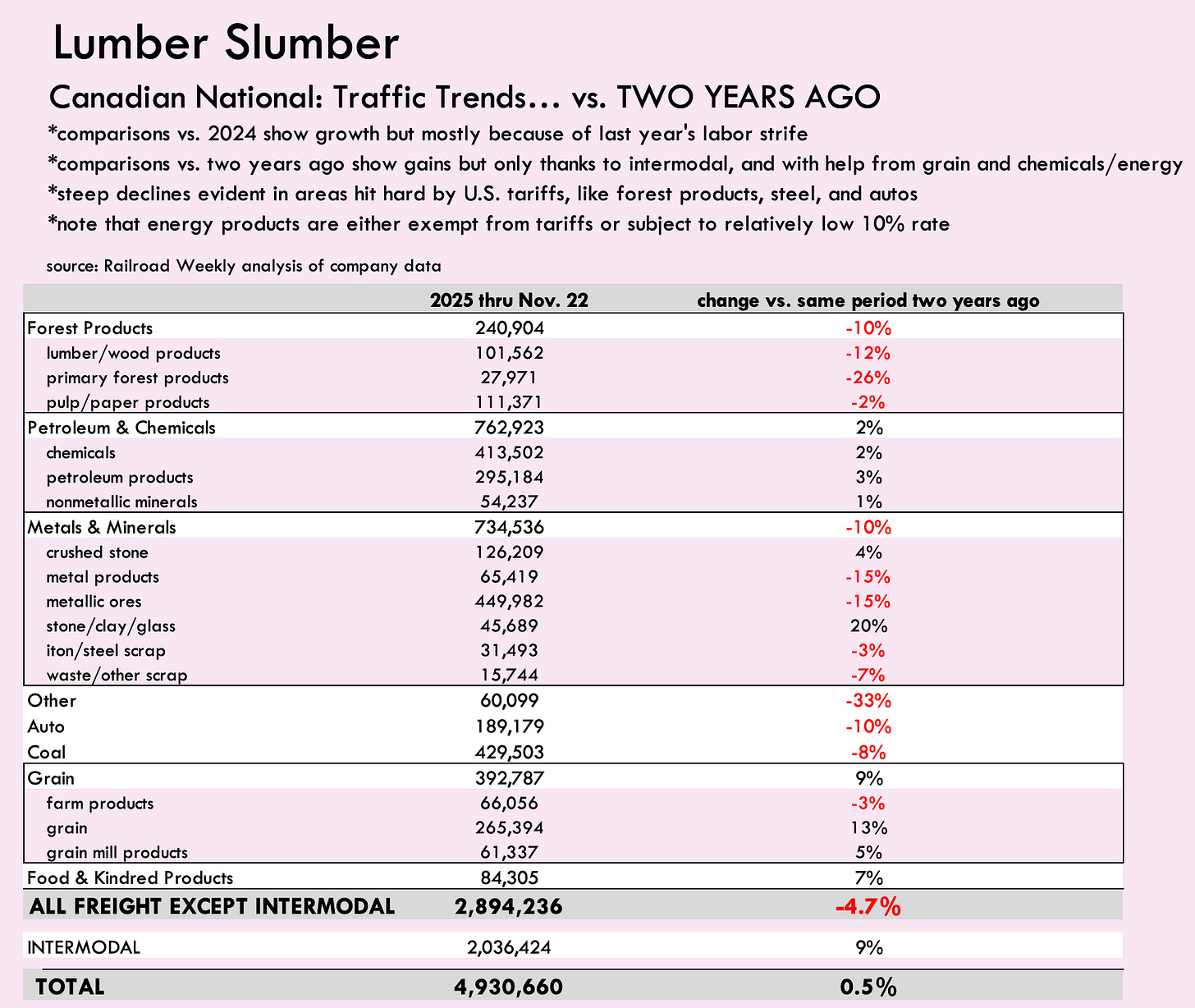

· But how is traffic looking this year versus two years ago? Not so great. Things superficially look fine so far this year, thanks to strong intermodal growth. Container traffic is up 9% through the first 47 weeks of the year, compared to the same 47 weeks of 2023. But excluding intermodal, CN’s carload volumes so far this year are down 5% from two years ago.

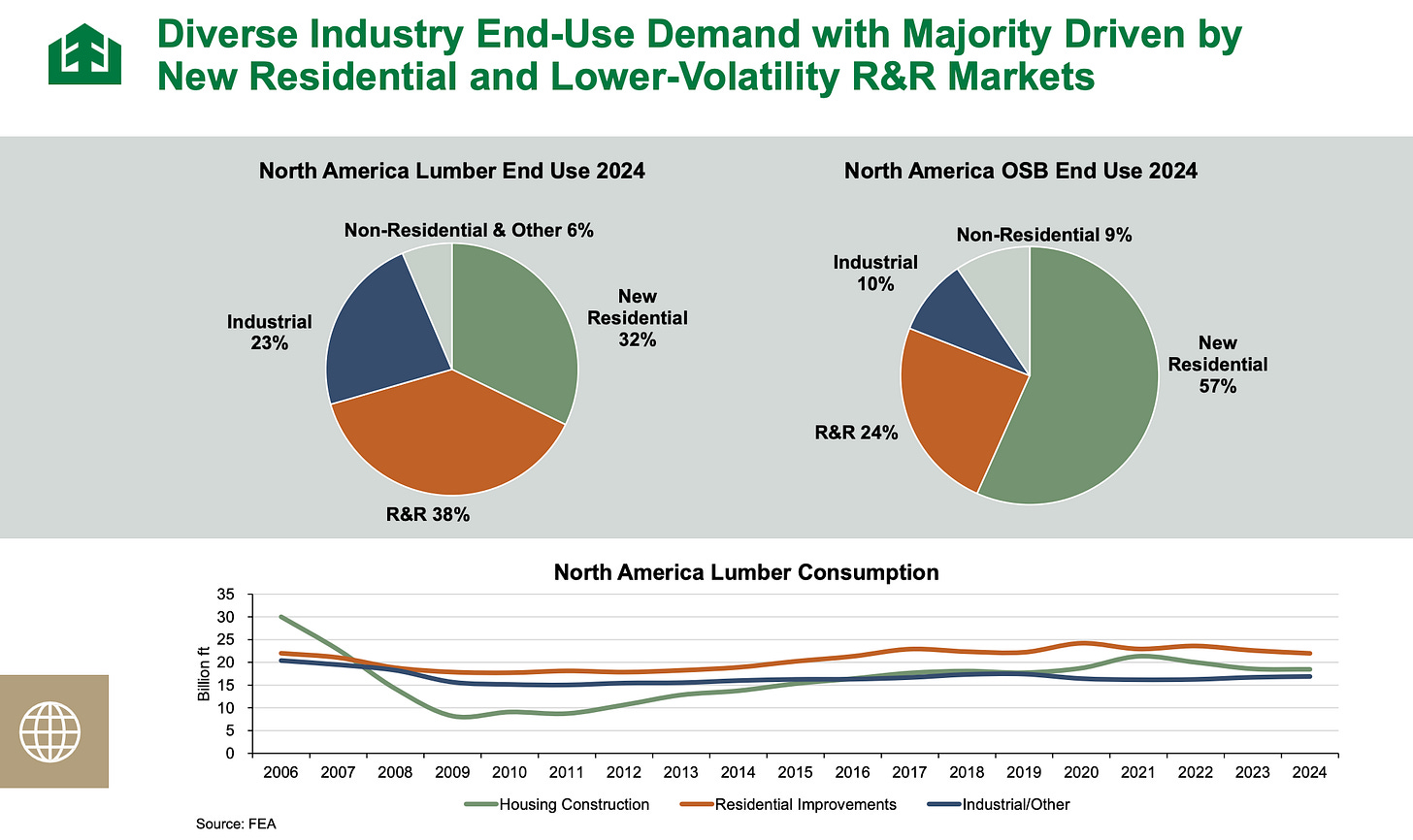

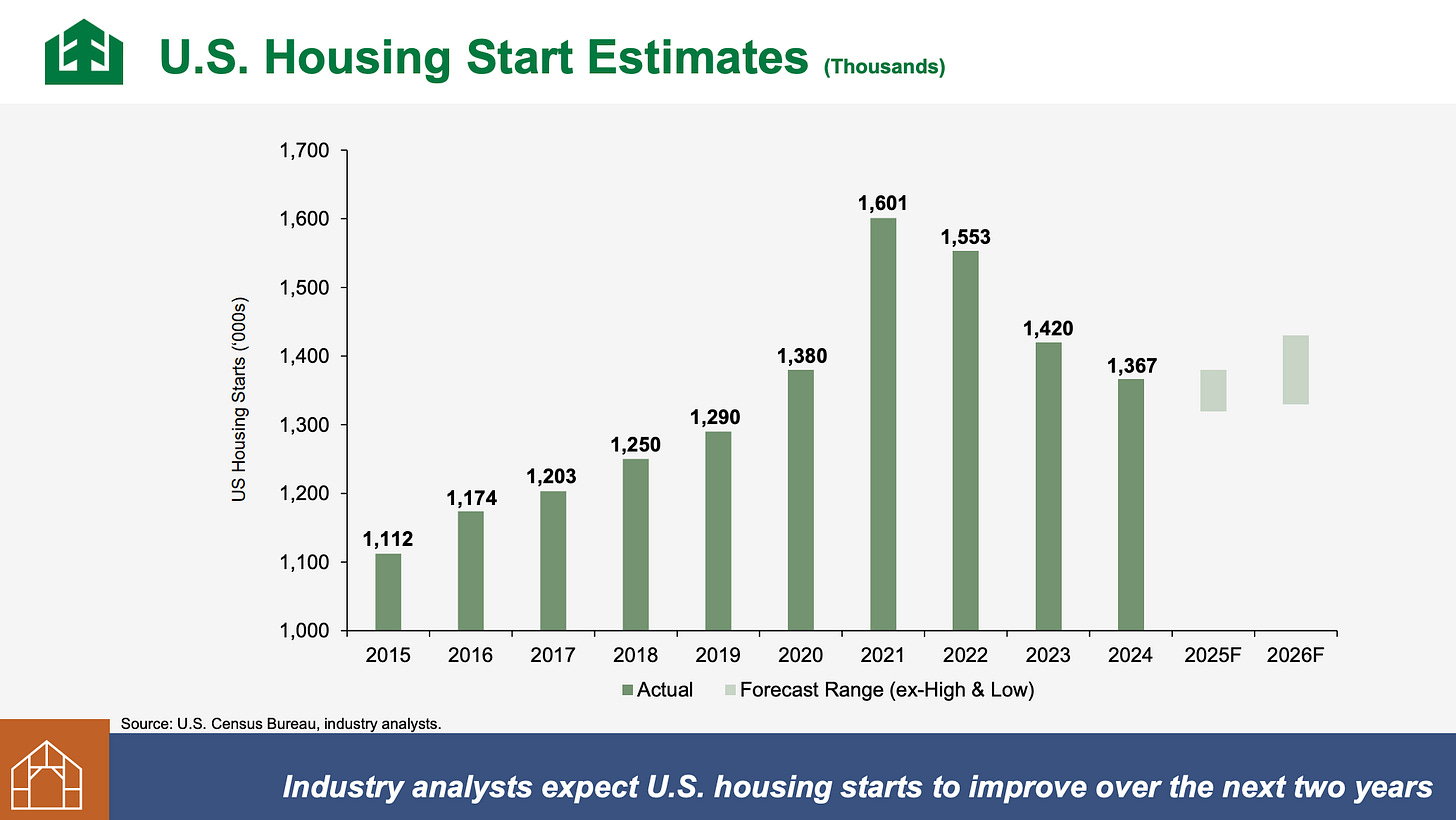

· You can see from the chart above how different freight categories have trended over the past two years. Lumber shipments, most strikingly, are way down in response to a 45% U.S. tariff. Lumber centerbeams, used for homebuilding, have fallen sharply in price, to what Houle said were below breakeven levels for Canadian producers. CN moves more lumber in North America than any other railroad. Note below some trends in the housing-sensitive lumber business (R&R refers to the repair and remodeling market).

· On the other hand, Houle said CN’s intermodal business is performing “quite well,” including the truck-competitive domestic segment. There’s of course the big

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.