Inside This Issue

· Resilient and Ready: CN Faring Well but Preparing for Hell

· Forecast Decline, But We’ll Be Fine: CPKC Reassures Amid Tariff Wars

· Leap in the Heart of Texas: BN Delivers Solid Jump in Q1 Profits

· For All RRs, Business Still Humming: But is an Earthquake Coming?

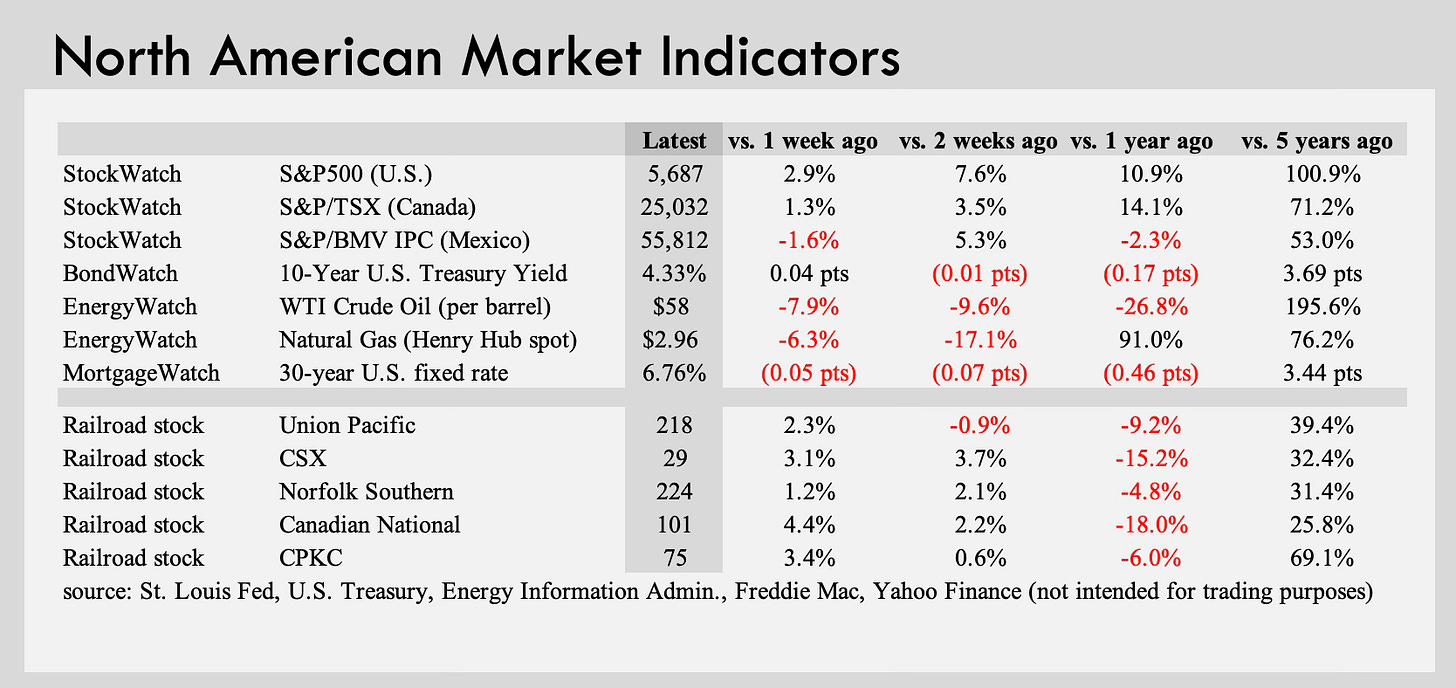

· Cheers Amid the Fears: Stocks Rebounding Despite Tariff Worries

· Port Report: Los Angeles Eyeing Drastic Import Plunge

· Question for This Week: What Will the Fed Say on Wednesday?

Please kindly refrain from sharing and forwarding Railroad Weekly. Discounts are available for companies with multiple readers. Please email jay@railroadweekly.com for more info. Thanks for your cooperation!

Track Talk

“We’re not planning for a recession, but we’re always prepared for one.”

-CPKC CEO Keith Creel

The Latest

· Feeling reassured? Investors seem to be breathing easier. The U.S. stock market, or at least the S&P 500 index, is now back above where it was before its “Liberation Day” plunge on April 2nd. Railroads have likewise enjoyed a stock price recovery, joining many other companies throughout North America in reporting strong first quarter trends and good trends so far in the second quarter. As for the quarters ahead, everyone still talks about heightened uncertainty. But you don’t hear a lot of outright panic, though there’s certainly some of that (especially among small businesses that import from China). Canadian National said last week it’s sticking to its original financial and volume growth guidance for the year—CN boasts of being “resilient and ready” for whatever comes. CPKC lowered its guidance some but still thinks that whatever transpires in this year’s second half can’t be as bad as what transpired in last year’s second half (remember all the labor unrest?).

· Investors and companies received further reassurance from the U.S. job market, which grew by 117k new positions in April. Interestingly, 16% of those new jobs came in the transportation and warehousing sector. Within that category, railroad jobs ticked up a bit, but the biggest gains were in warehousing and storage, which reflects a major theme of U.S. economic activity this spring: Companies stocking up on inventories to preempt tariff inflation. Households—for that same reason—are rushing to buy everything from automobiles to home appliances. Do it now before things get more expensive.

· At first glance, last week’s U.S. GDP report looked anything but reassuring—it showed the economy shrinking at an annualized rate of 0.3%. Reports suggested all that pull-forward importing erased from GDP. But that’s not quite accurate. Imports do not subtract from GDP (it’s a common fallacy). Here’s a good example from the economist Noah Smith that explains what’s going on: “Suppose an American company, Best Buy, decides to buy a Chinese TV and put it in a warehouse, because it knows that tariffs are coming soon. That purchase counts as inventory investment. So, investment goes up by $1,000 [and]… net exports go down by $1000. The two cancel out, and the total contribution of the imported TV to U.S. GDP is zero.”

· Great, then. No harm, no foul from the tariffs. Well, not quite. The economist Joey Politano gives another example of an American construction company that rushed to buy wood from Canada ahead of tariffs. That action in itself wouldn’t impact GDP. “But if that company slowed down construction so it could afford to stockpile inputs, that would show up as a hidden drag on GDP in the form of lower investment. In other words, tariff front-running can indirectly slow the economy, and that’s exactly what we saw at the start of this year.”

· Bottom line is that the Q1 GDP report featured mixed messages from which conclusions are hard to draw. Household and business spending was indeed strong. But was this spending merely pulled forward from future quarters? Remember also that Q1 ended in March, before the tariff-tumultuous month of April. Stay tuned.

· As the year progresses into summer and fall, surely there’s more economic pain from tariffs to come. Los Angeles port director Gene Seroka is making the media rounds telling anyone who’ll listen that LA port traffic will be down more than 35% this week versus last year. He told Bloomberg: “Major retailers, home-improvement stores, and even manufacturers who source parts from China are saying that imports from that country have all but stopped because the price of products made in China now is two and a half times what it was last month. And they just can’t justify that.” The customs broker Expeditors added, “We certainly know these are incredibly impactful staggering financial hits to importers, particularly with goods from China.” Concerns are mounting—occasionally voiced in corporate earnings calls—of upcoming product shortages, small business closures, and rising unemployment.

· We’re in for another hyper-eventful week with the Fed announcing its next interest rate decision on Wednesday. In the meantime, markets will be looking for any indication of a U.S.-China tariff détente. They’re also watching for any updates to the reciprocal tariff policies currently scheduled to take effect in early July (after an impromptu three-month delay). Until then, a 10% rate applies for most countries. The auto sector did get some modest relief last week. Chinese shippers of small packages did not, affecting many American online shoppers.

· And just in case you were still bored amid all this, Canada held its big election last week, keeping Mark Carney as prime minister.

Read American Places, a book with deep insights into the most important trends and developments throughout the U.S. economy -Jay Shabat, Publisher, Railroad Weekly

Other Developments

· At an Omaha investor event hosted by Gabelli Funds, Union Pacific’s CFO Jennifer Hamann said the railroad was off to a strong start this year, which augurs well for producing better profit margins in 2025 than in 2024. So far in April, “our volumes have stayed strong.” But of course, the tariff situation makes the outlook “very fluid.” April’s volume strength, meanwhile, is surely getting a boost from “some pre-shipping ahead of the tariffs.” And so, as UP looks ahead, “We’re expecting probably in the next couple of weeks to see that drop pretty substantially.” Hamann is specifically referring to international intermodal shipments, which are headed for a steep plunge. But she clarifies that “it’s not going to go to zero because when you think about the west coast ports, certainly, China is a big part of that, but then you also have southeast Asia, and we’re actually seeing some increases in terms of business that’s coming from the southeast Asia part.” It’s unclear what happens later this summer and beyond, with tariff policies changing by the week. International intermodal shipments, she explained, are profitable for UP but 40% to 50% below average in terms of the revenue it generates per car. Coal tends to be somewhat below average too. Industrial products like construction materials, steel, plastics, chemicals, and lumber tend to be above the system average. Autos are firmly above average. Hamann also talked about UP’s strength in Mexico, its many new growth initiatives, and its tools to boost profit margins, notably pricing, asset utilization, volume growth, and use of technology.

· Cleveland-Cliffs, a major steel producer and major rail shipper, announced the closure of a Pennsylvania plant that specializes in making steel for rails. It denied that tariffs were the reason. But clearly, tariffs pose challenges for the company, notwithstanding its tariff support—it doesn’t like the foreign competition. Its most important customers are automakers, which face severe tariff-related challenges. General Motors, for example, said last week that tariffs could cost it as much as $5b this year alone.

· Norfolk Southern, according to the Journal of Commerce, is axing international intermodal service on several eastern routes. The report said the move will affect 20 routes along the east coast, “including trains between the Port of Virginia and the key inland hub of Memphis, due to insufficient container volumes.”

· At an event hosted by Semafor, CSX CEO Joe Hinrichs shared his latest thoughts on the tariff situation. Like other railroads, CSX is seeing the international intermodal spike resulting from pull-forward demand from businesses and consumers. But concerns are growing as new orders plummet, foreshadowing empty ports in the weeks to come. Automobile and steel shipments are likewise currently enjoying a jump in demand as consumers scramble to buy vehicles before prices increase. If demand does decrease as expected later this year, but more autos are ultimately built in the eastern U.S., CSX might yet come out ahead. But the outlook is unclear. “Everyone’s still trying to figure it out.” CSX’s two largest businesses are chemicals and coal, and the latter is today heavily exposed to export markets. Coal is shipped from mines in West Virginia, Kentucky, Illinois, and Alabama to various markets overseas. Underlying demand for these coal exports should stay strong but could be impacted by retaliatory tariffs imposed by other countries. Less impacted are shipments of grain, aggregate rock, domestic energy coal, etc. CSX still has 600 development projects along its network right now—it was more like 500 just a few months ago. So, activity is increasing, but projects typically take years to materialize. One that just opened is a Hyundai plant in Savannah, first announced in 2019. Hinrichs separately discussed efforts to improve workforce morale, his eagerness to grow the railroad’s volumes, the promise of artificial intelligence, the social benefits of rail (it’s safer, cleaner, and self-financing), and the future of hydrogen-powered locomotives.

· Trinity, a railcar builder and lessor (among other things), said prospective customers have been slower to convert inquiries to orders, though inquiries have in fact been high. “Inquiry levels at the beginning of 2025 were the highest they’ve been in several years, but customers are taking longer to make capital decisions… We know the demand for railcars is out there given the aging profile of the fleet and solid inquiries we continue to receive from our customers.” The company is closely watching U.S. industrial production, which for now remains positive but threatened by extreme market uncertainty. Citing industry data, Trinity expects the North American railcar fleet to contract for the first time in about two years. That said, “Our customers need the railcars they have in their fleet.” Lease rates are increasing, in part reflecting low storage rates, higher input costs, and higher interest rates. Trinity says it will be “opportunistic as a railcar lessor, disciplined as a railcar builder, and innovative with our customers.” It currently foresees new car deliveries of between 28k to 33k this year. That would be down from 42k in 2024 and 45k in 2023.

· Bloomberg’s OddLots podcast featured an interesting interview with AGT Foods CEO Murad Al-Katib, also known as “The Lentil King of Saskatchewan.” It’s a discussion about Canada’s giant ag sector and its challenges with tariffs, featuring many mentions of—you guessed it—railroads. You can listen here.

· Stay tuned next week: Railroads will be presenting at multiple investor conferences, sharing their latest insights on the tariff issue.

Q1 Earnings

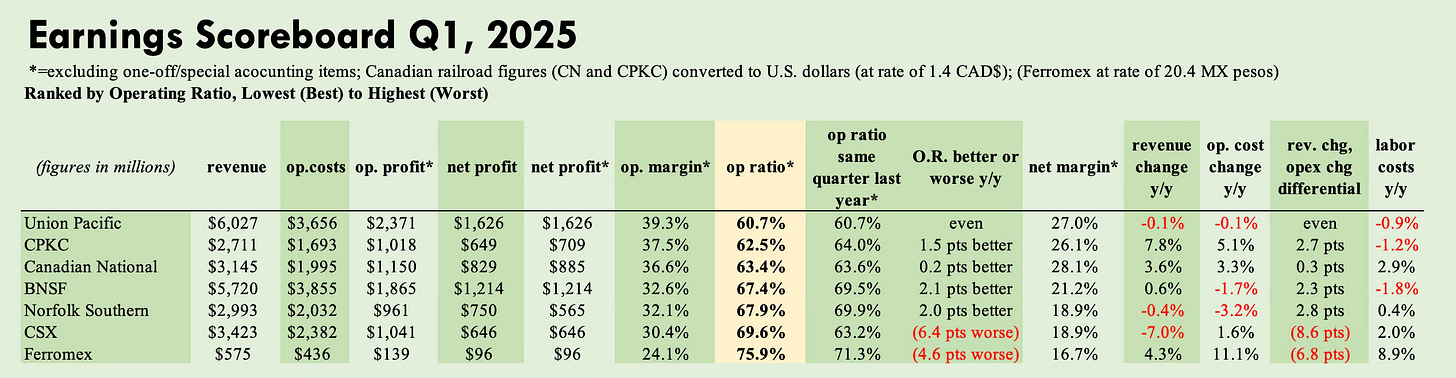

Canadian National

· Resilient and Ready. Canada’s largest railroad said both adjectives apply as it navigates the high-stakes tariff war. So far, like other railroads, CN hasn’t seen any major disruptions. “We’ve not seen a significant impact to our volumes thus far.” But it’s certainly not assuming that things will stay this way. “There’s no question that uncertainty has increased over the last few months, and we’re seeing a heightened risk of recession in both Canada and the U.S.” CN is optimistic that the U.S. will ultimately agree to new trade deals, not just with Canada but also China and other countries. However, “We don’t know what those deals will look like nor when they will happen.” Whatever comes, CN insists it’s “well positioned to enable global trade regardless of potential changes in trade patterns. We have the right service and available capacity at all three coasts of North America to provide our customers with gateway options. So, we’re ready.”

· The year, happily, got off to a strong start. CN slightly improved its Q1 operating ratio y/y, to 63.4%. That’s as 4% revenue growth slightly outpaced cost inflation. The favorable trends continued into April, giving the company “a good first four months under our belt. We’re on plan. We’re where we wanted to be.” Potential trade and economic headwinds aside, this year’s second half should be better than last year’s, if only because last year’s performance was badly disrupted by labor strife. The labor situation is much calmer now, with a new three-year wage deal with engineers and conductors now in place following an arbitrated settlement. In addition, “We continue to make progress on labor agreements in the U.S… We’ve now reached ratified agreements with nine unions, representing roughly half of our U.S. workforce.”

· And so, CN is sticking to its original financial guidance, specifically its forecast to grow earnings per share by 10% to 15% for the full year. Though the trade war could make achieving that tougher, CN says it should be able to deliver “as long as we see y/y volume growth.” Q1 volumes, in RTM terms, increased 1%.

· It was a tough first quarter weather-wise, even by Canadian standards. “Winter conditions really hit hard in February and not just in the west where we’re used to seeing cold temperatures. We also had some extreme cold and record snowfall in the eastern region and saw considerable flooding in the southern region along our Chicago and New Orleans corridor.” This negatively affected velocity, dwell times, train lengths, and other operating metrics. Fortunately, “When the weather broke in March, the network quickly rebounded,” and operations improved. Improvements came, importantly, with 2% lower average headcount versus a year ago. CN in fact moved more gross ton miles worth of freight in March than it did in any one month since April of 2022.

· Demand, meanwhile, was strong across most freight categories, led by grain and coal. The petroleum and chemicals segment likewise saw solid volume and revenue growth, boosted by natural gas liquid exports through Prince Rupert. This offset softer refined petroleum volumes due to a production issue at a customer facility and lower southbound biodiesel shipments.

· On the other hand, potash and iron ore were two areas of weakness, with both areas seeing softer export demand. Both also experienced production issues at customer facilities. Frac sand volumes declined but mostly because of weather-related train length restrictions—demand was in fact strong.

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.