courtesy: Steel Wheels Photography

Inside This Issue

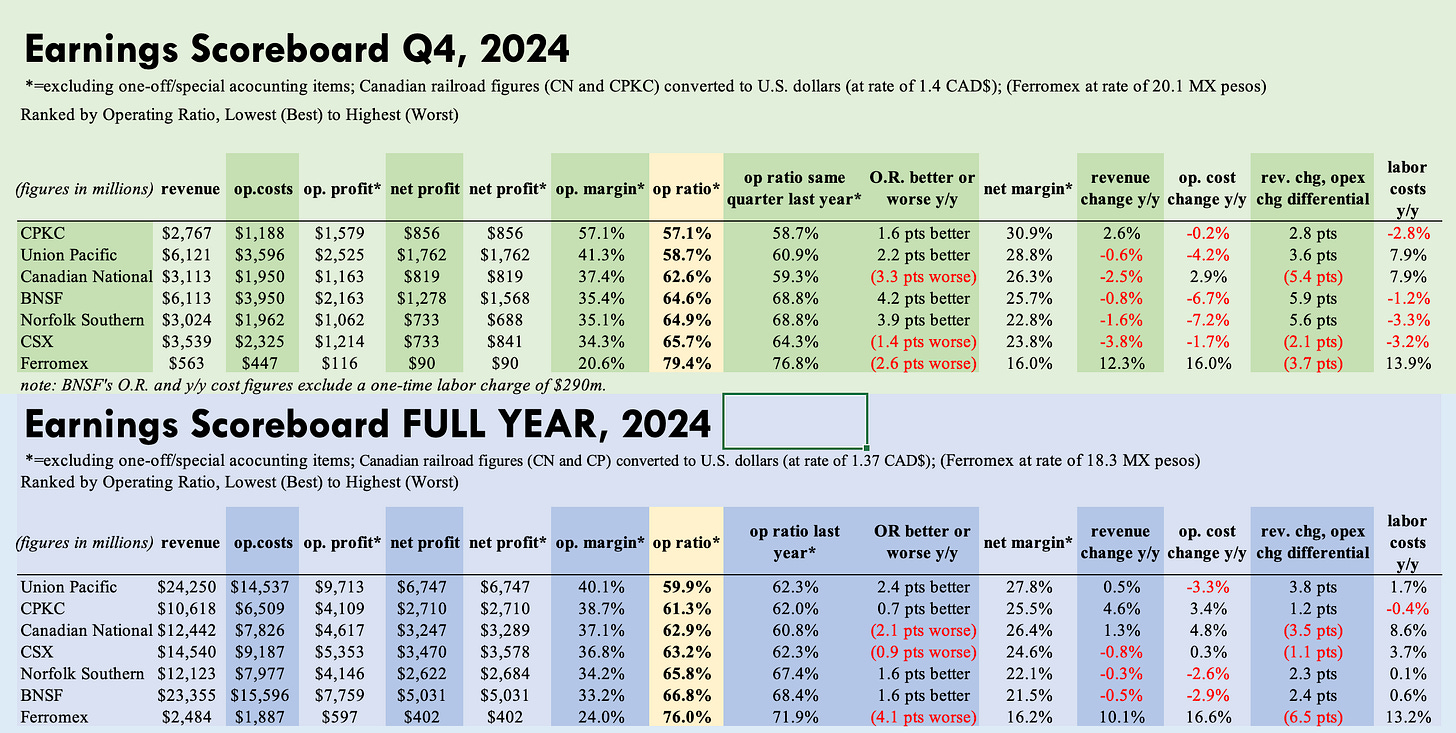

· Rebirth in Fort Worth? BNSF Ups its Score in Q4

· Positivity from Productivity: BN Margins Grow, with Efficiency an Ignition Key

· Uncertainty? Yes. Are We Panicking? No: RRs Respond to Tariff Talk

· Labor Tranquility to Lift Profitability: Canadian RRs Still Bullish on 2025

· Trucked Up: CSX Says its O.R. Inflated by Quality Carriers

· Me Warn About Seaborne: Export Met Coal Trends Causing Unease

· Thermal Back to Normal? UP and Others See Positive Vibes in Energy Coal

· Pause for Policy: Trinity Sees Railcar Customers Hesitant Amid Tariff Concerns

Track Talk

“Sometimes you have to go through the dark to get into the light.”

- Norfolk Southern CEO Mark George

The Latest

· Q4 railroad earnings season is now complete, with Berkshire Hathaway having published BNSF’s financials this weekend. As you’ll read about below, North America’s largest railroad showed impressive margin gains in the year’s final quarter (excluding one-off accounting charges), underpinned by booming intermodal volumes, employee productivity gains, and faster network velocity. Key segments like ag, energy, and chemicals fared well, offsetting areas of weakness, most importantly coal. But there’s more work to do: BNSF still trailed all of its Big Six Class I peers in operating ratio last year.

· Read on for a detailed update on the latest industry trends, straight from the CEOs of UP, CSX, NS, CN, and CPKC. All were in sunny Miami last week, addressing questions from investors. Needless to say, they were asked about tariffs. They also gave updates on volume trends for the first month-and-a-half of 2025.

· Speaking of which, AAR data for the first seven weeks of the year show North American rail traffic up about 4% y/y, lifted by a nearly 5% gain in the U.S. Growing markets include chemicals, energy, agriculture, and intermodal, the latter still growing especially fast. In fact, carload traffic alone (in other words, ex-intermodal), is down 1% continent wide. Coal, metals, minerals, autos, and forest products are all down from last year.

· Some other updates: Eastern railroads are dealing with severe weather impacts in areas around Kentucky, Ohio, Virginia, and West Virginia. Norfolk Southern described successful efforts to reduce dwell times and improve throughput at its Elkhart, Indiana railyard, which typically handles 1,800 to 1,900 railcars daily. The food maker Kraft-Heinz says it’s “unlocked” $1.3b in efficiencies since the start of 2023, on its way toward a goal of $2.5b. It aims to capture the final $1.2b from—among other initiatives—“increasing our use of rail.” Trican, a Canadian oilfield services firm, described efforts to build new transload facilities in British Columbia, facilitating more sand shipments by rail. “We can rail the sand into Northeast BC and truck from there.” Enrivi, which owns a railway track maintenance and construction firm called Harsco, told investors that during Q4, “demand for rail standard equipment and services remained strong.” New STB chair Patrick Fuchs gave an update on several long-standing Board proceedings, pledging to speed things up and provide more transparency. Los Angeles port director Gene Seroka, meanwhile, said strong y/y volume gains continue into 2025, driven by three key factors: 1) the ongoing strength of the American consumer, 2) pull-forward efforts by shippers importing before tariffs take effect, and 3) diversions to the west coast from disruptions in the Panama Canal, the Suez Canal, and east coast labor developments—eastern dockworkers will vote on their new contract agreement this week.

· Stay tuned this week as Raymond James hosts an investor event in Orlando (why is everyone going to Florida this month?) CPKC’s CFO Nadeem Velani is among the scheduled speakers.

Q4 Earnings: BNSF

· America’s largest railroad was once again its least profitable last year. In 2024, BNSF recorded a 66.8% operating ratio, worse than even Norfolk Southern, another intermodal-heavy railroad, in its case one recovering from a trio of misfortunes (see below). Does BNSF simply carry too much lower-margin intermodal traffic to earn more competitive margins? Is it too dependent on agriculture? Does it carry too much coal? Does it need to more aggressively adopt Precision Scheduled Railroading? The railroad did, remember, hire PSR maven Ed Harris as a consultant last year, to help boost operating efficiency. It’s taken many other steps too, which are in fact delivering significant earnings momentum.

· Indeed, BNSF’s 2024 O.R. was better than 2023’s by almost two full points. More impressively, its Q4 figures improved by more than four points, to 64.6%. This beat both Norfolk Southern and CSX, though in fairness, both dealt with highly disruptive hurricanes last quarter. BNSF’s figures exclude a one-time $290m charge, linked to a new labor agreement with the SMART-TD union, signed in December. The agreement allows the railroad to redeploy brake-persons to conductors and engineers, addressing “short-term hiring demands.” Railroad Weekly has excluded that $290m charge from the full-year figures as well.

· Absent that charge, BNSF’s Q4 labor costs would have declined 1% y/y, bringing total operating costs down by an impressive 7%. This was largely responsible for the big O.R. improvement—revenues were down 1%. As a privately-held company, BNSF’s parent Berkshire Hathaway doesn’t hold earnings calls or present at industry investor events. That means fewer details about its financial data. It did speak of full-year gains in “employee productivity.”

· Its annual report also disclosed that revenue per unit (RPU) dipped 7% from 2023 to 2024, “primarily attributable to lower fuel surcharge revenue and business mix changes, partially offset by a net volume increase of 6.5%.” Keep this in mind when looking at last year’s revenue decline: This was heavily influenced by cheaper fuel, which also shows up as lower costs. More substantively, BNSF’s big coal business produced 18% less revenue last year. Fortunately, intermodal came to the rescue with a 17% revenue gain. Ag revenue rose 7% while revenue from industrial products dropped 1%.

· As for volumes last year, BNSF flagged a decline in aggregates, taconite, minerals, and waste shipments. But it moved more plastics and petroleum products, as well as more grain, renewable fuels, and fertilizers. CEO Katie Farmer, speaking at a rail shipper event in Chicago last month, also mentioned record volumes of parcel shipments for UPS and FedEx during Q4’s holiday season. She also said carload network velocity at the end of 2024 reached its best level since 2016. (Farmer is scheduled to speak again at the Southwestern rail shippers event in Dallas next month).

· In his annual letter to shareholders, Berkshire’s chief Warren Buffett didn’t mention anything about railroads, other than saying BNSF—despite its earnings improvement—has “much left to accomplish.” Buffett, now 94, will at some point hand the CEO reigns to his trusted lieutenant Greg Abel. Berkshire, by the way, will hold its famously festive annual meeting in Omaha on May 3rd this year.

· Looking ahead, BNSF will this year be focused on handling the current surge in west coast imports. It’s keen on developing its Quantum premium product with intermodal partner J.B. Hunt. It’s pleased to see California drop a proposed new engine emissions rule that threatened the viability of BIG, BNSF’s billion-dollar plan to expand capacity in Barstow. It’s opening and expanding logistics parks and logistics centers elsewhere in the network. Its prized southern transcon line is now nearly all double-tracked at least. It’s cultivating shortline partnerships. It’s investing in new technology. And it’s working to improve operations in Mexico, an important potential growth market.

The Economy

· Walmart unveiled another set of excellent quarterly financial results last week, another reason to suggest the U.S. economy remains strong—Walmart after all, is America’s largest employer and largest company (by sales). But the Arkansas-based retailer spooked investors with a rather tepid future sales forecast, triggering some fear across Wall Street. Stocks, including railroad stocks, declined for the week. Walmart did reassure that its U.S. customers “remain resilient” and that tariffs “are something we’ve managed for many years, and we’ll just continue to manage that.” It also said again that more of its sales are coming from upper-income households, and that immigration crackdowns aren’t having any impact on its labor force. Looking back, Walmart is a company whose success was made possible by the revolution in container shipping, which enabled Americans to buy goods produced more cheaply abroad, especially China.

· Some informative data on the U.S. labor market from the Wall Street Journal: “Undocumented immigrants in the U.S.,” it wrote, “make up about 4.6% of the employed labor force, or 7.5m people.” It was citing an analysis of 2022 Census Bureau data by the American Immigration Council, a nonprofit research and advocacy group. Undocumented immigrants, the study showed, account for 14% of construction workers, 13% of agricultural workers, and 7% of workers in hospitality. So far, in President Trump’s first month back in office, immigrant deportations—like tariffs—have been more bark than bite. According to Reuters, the new Trump administration has thus far deported 37,660 migrants, compared to a monthly average of 57,000 during the last year of the Biden administration.

Read American Places, a book with deep insights into the most important trends and developments throughout the U.S. economy -Jay Shabat, Publisher, Railroad Weekly

Highlights from last week’s Barclays investor event

Canadian National

· Let’s start in Canada, which faces a blanket 25% tariff (10% for energy products) on all exports to the U.S. The policy is currently scheduled to take effect next Tuesday (March 4th). Maybe the levies will be postponed a second time. Maybe they’ll be canceled outright. But Canadian National, for one, needs to prepare for the worst. CEO Tracy Robinson said simply, “I don’t know what’s going to happen and how it’s going to play out.” But after modeling different scenarios, CN thinks the impact will fall short of causing a Canadian recession or a U.S. inflation spike. There would, however, “be some impact from tariffs without a doubt.”

· Robinson recalled the first Trump administration, when the U.S. applied a 25% and 10% tariff on Canadian steel and aluminum, respectively, which disappeared after a year when the USMCA trade pact took effect. Regarding that year of steel and aluminum tariffs, Robinson said, “We didn’t see a significant impact from that.”

· She clarified that about 30% of CN’s volume crosses the U.S.-Canada border (20% southbound and 10% northbound). Most of the southbound flow involves energy products (petroleum, crude oil, etc.), which would be subject to the lower 10% tariff. Northbound, a lot of the traffic involves minerals and “a little bit of petroleum as well.” Robinson takes some comfort in the exchange rate: If tariffs cause the Canadian dollar to further weaken, that winds up being net positive for company earnings. Again with a backdrop of uncertainty, CN feels for now that it can withstand what comes. “All in, we’re expecting an impact, not a dramatic impact, and we’re ready for it.”

· Tariffs aside, 2025 will almost surely be a better year for CN than 2024. Last year’s labor unrest is now in the rearview mirror. This year is off to a good start with strong volumes. Operations are running well, notwithstanding pretty normal winter weather disruptions. Speaking of which, February has been a tough month, with CN forced to run shorter trains because of the extreme cold in some places. But it expects to ultimately move all freight left behind, without losing any business. It’s just a matter of catching up.

· CN is still committed to growing faster than the industrial economy, which of course hasn’t grown much at all these past few years. The Montreal-based railroad is still committed to pricing above inflation. It’s likewise still committed to its goal of growing earnings per share by 10% to 15% this year.

· Many of the railroad’s growth engines, Robinson reminded investors, have nothing to do with economic growth. They’re tied to Canada exporting more energy, for example, and projects like an expanding fuel facility in Toronto—new business in the eastern part of its network is especially welcome because of the spare capacity there. Back on the energy front, “We’re setting records on propane exports to Japan and to Asia every year.” Prince Rupert, a northern Pacific port where CN dominates, is expanding its terminals. Northern Alberta and British Columbia are receiving heavy investment in gas drilling. Many of these projects require frac sand that CN is moving there from Wisconsin. “You’re going to see a step function increase in that volume this year.” And again, such projects are largely decoupled from GDP growth.

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.