Not So Fast

Railroad Weekly October 20, 2025

Inside This Issue

· Not So Fast: Angel Preaches Patience; No Imminent Plot to Tie the Knot

· Steve’s Jobs: New CSX Chief To Focus on Basics Like Safety and Service

· He Intends to Make Friends: Angel Affirms Eagerness to Form Partnerships

· Third Flu: CSX Posts Lackluster Q3 Results; Expects Better This Quarter

· Flawed Abroad: Weakness Lingers in Export Coal Market

· Home Run: Demand Rising for Domestic Utility Coal

· No Sweat, No Threat: JBH Says it Can Still Work with NS Even if It Merges

· Roaches in the Kitchen? JPMorgan Asks: Do More Borrower Blowups Beckon?

· This Week: Q3 Reports from UP and its Fiancée NS

Track Talk

“Customer service has not been the hallmark of this industry historically.”

-CSX CEO Steve Angel

The Latest

· Q3 railroad earnings season is underway. CSX kicked things off with a rather downbeat vibe, highlighting concerns ranging from a still-weak industrial economy to a still-weak export coal market. The housing market is still weak. Interest rates, in CSX’s opinion, are still too high. Trucking rates are still uncomfortably low. Tariff concerns still fester. But the railroad’s outlook wasn’t all doom and gloom. Domestic coal shipments are up. So are shipments for non-residential construction materials. CSX is winning new intermodal business with help from new partnerships. Its operations are much improved. And total freight volumes are poised to show annual y/y growth.

· As for merger mania, CSX’s new chief Steve Angel immediately tempered expectations of an imminent merger deal. His focus will be on running a safe and efficient railroad. His priorities will include customer service, volume growth, and new partnerships.

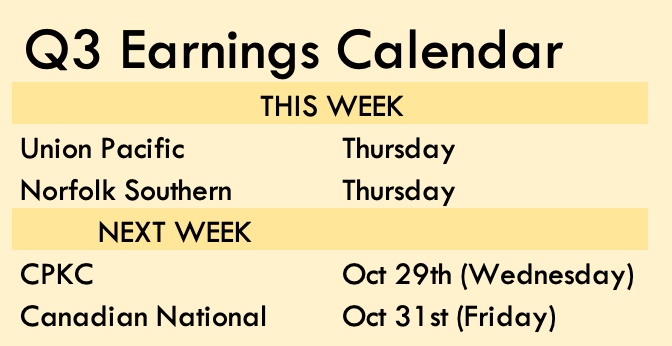

· We’ll get an even clearer picture of industry trends and developments this Thursday, when Union Pacific and Norfolk Southern both report (UP in the morning and NS in the afternoon). What more will they have to say about their merger plans? The two big Canadian railroads are scheduled to report next week.

Q3 Earnings: CSX

· Some angels descend from the heavens. This one came from a gas company, charged with leading CSX in the new era of railroad consolidation. Merger mania has come, and Steve Angel’s arrival makes it clear that CSX will be a player. Or maybe not. In his first earnings call with Wall Street, Angel—the railroad’s new CEO—essentially told everyone to take a deep breath. He spent ten years at the industrial gas firm Praxair, he said, before doing a merger deal. “I was very patient.” Strategic opportunities, he stressed, come when they come. “You've got to wait for the right timing. You've got to wait for when the conditions are right.”

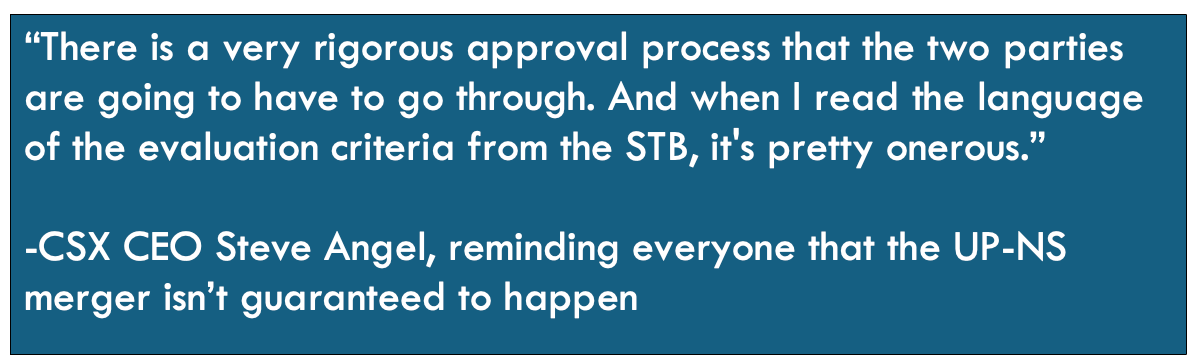

· Just as importantly, the Union Pacific-Norfolk Southern merger is hardly a done deal. STB approval, in other words, is hardly assured. Angel himself has bad memories of shipping with Union Pacific three decades ago, after it merged with the Southern Pacific. The integration, he said euphemistically, “didn’t go swimmingly.” In reaction to that messy merger, the STB imposed tougher merger approval standards, requiring railroad deals to enhance competition, not merely avoid making it worse. Angel highlighted the need for UP and NS to meet those tough new STB standards. CSX, he said, will have its own opportunity to review their merger application and act accordingly. “We also want to make sure that we have a chance to present our case, in terms of what we need to be competitive going forward. And that’s what we’ll do.” Put another way, CSX plans to be an active participant in the upcoming UP-NS merger battle, ready to make demands for concessions. “We’re going to make sure that we’re competitive no matter what.”

· While naturally engaged in the consolidation drama, Angel insists his primary day-to-day focus will be on running a safe and efficient railroad. His very first words in last week’s earnings call paid respects to his ousted predecessor Joe Hinrichs, who “led this company through some difficult times and worked with this leadership team to make some real progress.” CSX now stands in a “solid position… The railroad is running well, and we have a strong foundation to drive further improvements.”

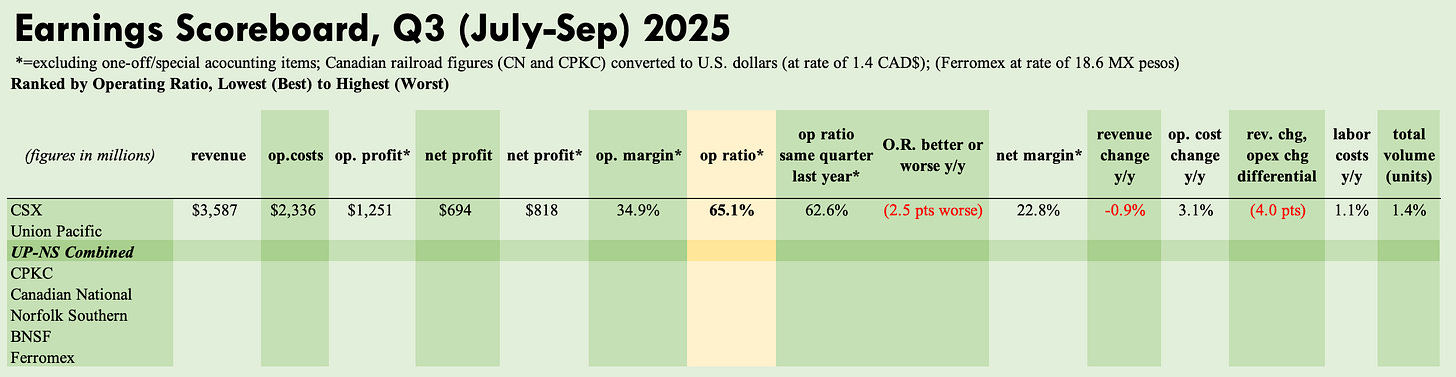

· How did CSX perform financially in the July-to-September quarter? Not great, by its own standards anyway. It was once again hobbled by operational strains from two major construction projects, leading to a 65% operating ratio (excluding special items). That compares to below 63% in the same quarter last year. Revenues declined 1% y/y while operating costs (again ex items) increased 3%. For all the complaints by investors like Ancora and others—that Hinrichs wasn’t enthusiastic enough about finding a merger partner—his ouster might have also stemmed from the company’s disappointing financial and operational performance this year.

· The railroad’s total volume did grow last quarter—CSX moved 1% more carload and container units of freight this year than last. But average revenue per unit (RPU) declined 2%. Average unit revenues weakened further in the capacity-pressured intermodal business. They weakened as well for ag and food shipments. But most problematically, RPU for coal plunged 9%. Overall, CSX’s Q3 coal revenue declined 11% on 3% less volume. The blame goes mostly to lower international coal prices, depressing what CSX can charge for exports abroad (its major export terminals are in Baltimore and Newport News). Export volumes in fact fell 11% y/y. The story was more mixed domestically. Weak coal demand from U.S. steel manufacturers and other industrial customers caused a 15% drop in volume. Management cited tariffs as one reason for the weakness here. Also note that two CSX coal mine customers experienced an outage last quarter.

· Here’s the good news regarding coal: Domestic demand for energy coal is enjoying a mini-renaissance thanks to all the power needed for AI data centers. As a result, CSX’s domestic utility coal volumes increased a hearty 22%. Highish natural gas prices also encouraged more coal usage for electricity production.

· The railroad’s coal business should improve this quarter and into 2026, with export coal prices stabilizing and the outlook for domestic utility coal still looking rosy. To be sure, weather is always a factor when it comes to energy demand—will it be a cold winter across the U.S. east? CSX separately explained that several coal mines are postponing their retirement, in response to both the uptick in power demand and more coal-friendly federal regulations.

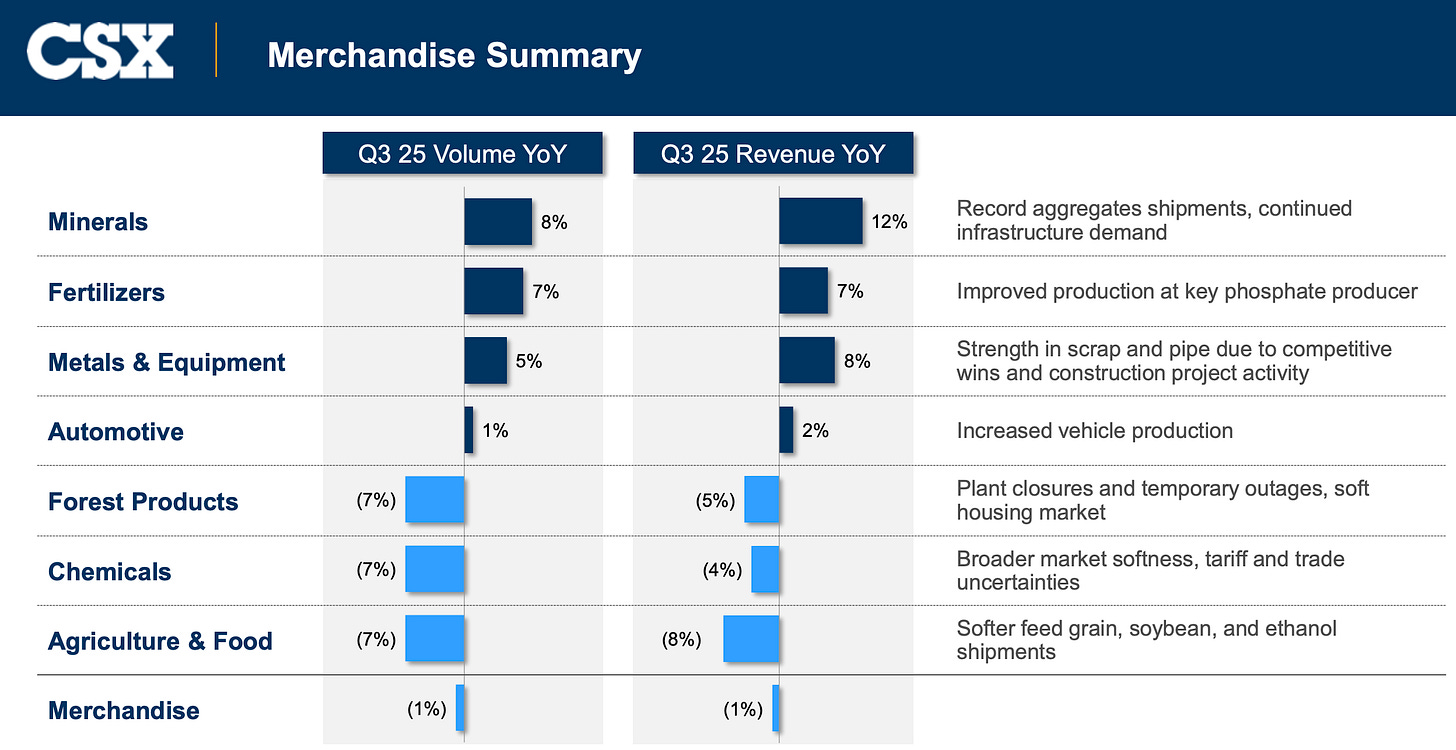

· Turning to other major CSX lines of business, chemicals and forestry products suffered from “broader market softness and tariffs.” Volumes fell 7% for both categories. The weak housing sector continues to weigh on forestry, a consolidating sector that also saw several plant closures and temporary outages. The ag business contracted too, in part because southeastern farmers didn’t need to rail in as much animal feed this summer (they had a rather robust local supply). Also in the ag space, ethanol markets saw increased competition, while weakness surfaced among “certain food and consumer products.”

· On a brighter note, the railroad enjoyed strong demand to move aggregates and cement, especially in the southeast. Fertilizer volumes rebounded thanks to improved production at a key phosphate producer (Florida is a big source of phosphates). CSX won some new business in the metals area. Auto production rose, too and should remain “relatively steady through year-end with minimal anticipated impacts from the aluminum supply challenges.”

· Finally, in the intermodal space, y/y Q3 volumes rose 5% and revenues rose 4%. Internationally, port volumes were up, and some of CSX’s key customers imported more containers. Domestically, it’s still a tough slog pricing-wise due to trucking overcapacity that seemingly never corrects. However, domestic shipments increased thanks to market share wins and new service offerings, including the new southeast-to-Texas/Mexico lane run jointly with CPKC. “We expect continued strength in our domestic business in the near term.”

· In addition to the new CSX-CPKC cooperation, CSX is also debuting new service lanes with BNSF and Canadian National. The CN arrangement involves containers coming into the ports of Vancouver and Prince Rupert, headed to Nashville via Memphis. The BNSF deal is more extensive, opening several new transcontinental lanes. Angel made clear that working with other railroads is a priority. “If you go back historically, we really haven’t had this level of cooperation as we’re seeing today.”

· Most intriguingly, Angel did say, “We’ve received quite a few inquiries on strategic opportunities.” He’s presumably talking about more partnerships rather than merger explorations. But he didn’t specify. For now, he stressed, “The whole focus is really performing well as a standalone company.”

· CSX will have some important tailwinds in 2026. For one, it won’t have the roughly $100m in costs associated with this year’s construction projects and the operational woes they induced. One of those projects meanwhile, expanding a Baltimore tunnel, will enable the railroad to run double-stacked intermodal trains up and down the east coast starting this spring. In the meantime, CSX continues to recruit new businesses to build along its network. It also anticipates a recovery in markets like chemicals and forestry, following an unusually rough and disruption-heavy 2025. As for intermodal, “We have one particular customer that’s highlighted that within the east that they see a huge conversion opportunity, and we’re highly interested in that. We’re highly interested in working with everyone to convert that.”

· On the other hand, economic anxieties persist across CSX’s customer base. “Customers face uncertainty and headwinds from shifting trade policies, weak global commodity prices, unsupportive interest rates, and a persistently soft trucking market… Tariff impacts and general consumer demand remain watch items.” It’s been about three years now without much meaningful growth in the U.S. industrial economy. Will 2026 be better?

· Management still expects total volumes to be up for all of 2025 vs. 2024. So far in Q4 (thru Oct. 11th), volumes are up 13% y/y, keeping in mind that last year’s Q4 featured major hurricane disruptions. It also featured labor instability at east coast ports, explaining why intermodal volumes this quarter are up 25% (everything else is collectively up 4%).

· How did investors react to CSX’s Q3 results, and to Angel’s debut remarks about the future direction of the railroad? The company’s stock price jumped 3% last week. Note on the Market Indicator chart below that CSX’s stock price is now up 7% from a year ago, while Union Pacific’s stock price is down 7% from a year ago.

Q3 Earnings: J.B. Hunt

· For J.B. Hunt, a Union Pacific-Norfolk Southern merger would be somewhat awkward. UP is the archrival of J.B.’s closest ally BNSF. But NS is J.B.’s chief partner in the eastern U.S. Addressing this “elephant in the room,” CEO Shelley Simpson, during the company’s Q3 earnings call, acknowledged both the “opportunities and risks that consolidation presents.” Importantly, the company has experience navigating seven prior Class I mergers.

· One major misconception the company was keen to correct: That a UP-NS merger would mean “that J.B. Hunt would have to move our traffic to CSX… That’s not accurate at all.” There’s nothing about a combined UP-NS “that would mean our current Norfolk Southern footprint that we have today would be required to change.”

· In any case, no matter what happens, “As the largest domestic intermodal provider, our scale and influence allow us to coordinate complex intermodal moves and deliver unique solutions for our customers.” It added, “We are one of the largest purchasers of rail capacity in North America, and we will engage in discussions with all rail providers to execute on a strategy and plan that we think is in the best interest of our shareholders.”

· It gave an interesting fact: Roughly half of J.B. Hunt’s transcon shipments are interchanged with a steel-wheel interchange, meaning railroad-to-railroad; no in-between truck drayage.

· Back on the merger front, whatever happens, J.B. Hunt vows to stay “actively engaged.” It will, all the while, maintain its push to convert more freight from highways to railways. Some of that is indeed happening, it said, thanks in part to BNSF, NS, and CSX delivering “excellent service.”

· Demand for domestic container shipments, unfortunately, “wasn’t all that strong” in Q3. Executives explained that imports peaked early on the west coast this year, likely the result of pulling demand forward in advance of new tariffs. “That said, it is important to disconnect the timing of peak season on the water from peak season of the inland supply chain… Our conversations indicate there is a large amount of freight that was imported early that hasn’t moved through the inland supply chain yet. No one has canceled Christmas.”

· J.B. Hunt’s intermodal volumes were down 3% y/y in July and down 2% in August before turning flat y/y in September. Transcon volumes looked worse, owing to comparisons with last year’s west coast spike during east coast labor tensions. But Q3’s eastern loads rose 6%, which likely reflects some of that road-to-rail shift J.B. Hunt and its railroad partners are gunning for. Note that the company includes Mexico in its eastern category, and there’s some “really nice solid growth coming northbound out of Mexico.” This broader “eastern” zone is where J.B. Hunt expects “the vast majority of the millions of loads that remain to be converted from highway to intermodal.”

· Encouragingly, more truck capacity has exited the market, “and the pace of exits is accelerating.” Now, if only the demand environment would improve!

The Economy

· Railroads aren’t the only ones reporting their Q3 earnings. Many of America’s largest publicly traded financial institutions held earnings calls last week, delivering a broadly upbeat message on the economy. Loan defaults are pretty low and consumers are still spending. As one example, Ally Financial, an auto lender, said it’s “observing consumer behaviors that are honestly better than our expectations… I appreciate there’s a lot of macro uncertainty in the environment, but we’re not seeing that impact our credit performance.”

· There’s more concern, however, about the default risk of non-public financial institutions that don’t take deposits, specifically private equity and debt firms that have become a much larger part of the U.S. financial sector since the 2008-09 recession. Asked about the messy blowup of Tricolor, a subprime auto lender, JPMorgan CEO Jamie Dimon said his “antenna goes up when things like that happen.” He then made a comment that became the talk of Wall Street last week: “I

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.