More Than a Feeling

Railroad Weekly July 21, 2025

Inside This Issue

· More than a Feeling: A Transcon Merger Might Actually Happen

· UP Just Might, With NS Unite: Merger Talks Reportedly Underway

· Growth Decreased? Look to the East; Is Transcon the Magic Wand?

· UP to Speak This Week: RR to Report Q2 Earnings on Thursday

· Scope to Elope? Would Regulators Approve a Transcon Merger?

· Highway Robbery: J.B. Hunt Winning More Eastern IM Biz

· Miller Instinct: G&W Chief Discusses Latest Shortline Trends

· Risk Jockey: Will Trump Cause a Slump? Policy Risk Steepens

Track Talk

“A transcontinental merger would, we think, be good for customers.”

- UP CFO Jennifer Hamann, speaking at a Bank of America event on June 24th, 2025

A Union Pacific Mega-Merger? Blockbuster News Reports Say the Wheels Are in Motion

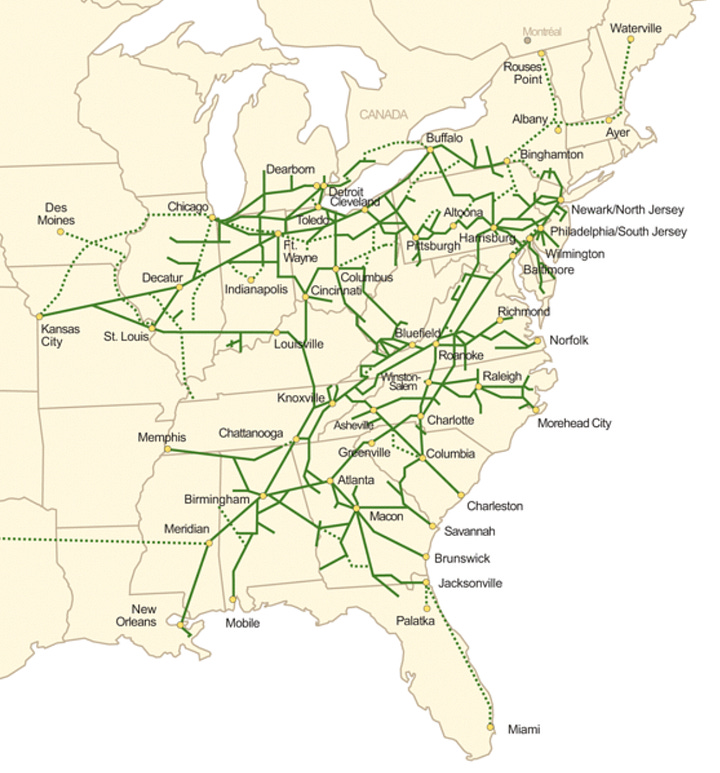

· It’s more than just an academic discussion now. A transcontinental railroad merger might actually happen. Last week, the news site Semafor reported that Union Pacific is working with the investment bank Morgan Stanley to explore the idea of buying an eastern railroad. One day later, the Wall Street Journal said merger discussions were underway with Norfolk Southern. The Journal report was clear, however, that “the talks are early stage and there are no guarantees they will result in any deal or receive regulatory signoff.” The Associated Press later wrote that “the merger discussions began during the first quarter of this year, according to a person familiar with the talks.” As of Sunday, Union Pacific had not made any public comments about the matter. The company did not respond to Railroad Weekly’s inquiries.

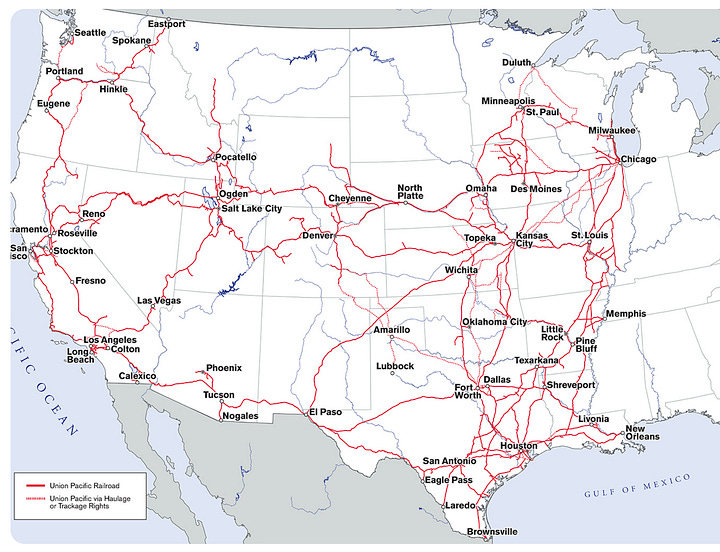

· Union Pacific, one might say, was born with a defect. When created after the Civil War, it ran westward to California from Omaha. Most of the nation’s economic activity, however, was happening well east of Omaha. Western activity like agriculture and mining was heavily dependent on markets in Chicago in particular, a good 500 miles or so east of Omaha. From its earliest days therefore, UP was contemplating how to build its network eastward. It never managed to extend east of Chicago, instead building a powerful network throughout the west via consolidation (following industry deregulation in 1980). UP bought the Missouri Pacific and Western Pacific in the 1980s, and the Chicago/Northwestern and Southern Pacific in the 1990s. As early as the 1960s, it was contemplating buying eastern peers like the ailing Pennsylvania Railroad.

· Also in the 1990s, Burlington Northern and Santa Fe created BNSF, rivaling UP in

western market power. The new BNSF then sought to leap ahead by striking a deal to merge with Canadian National in 1999. That deal, however, would fall apart amid heavy resistance, not least from UP. The angry pushback prompted the STB to impose a 15-month pause on new merger activity. One reason was shipper angst about severe service disruptions caused by UP’s failure to smoothly integrate Southern Pacific. Norfolk Southern and CSX too, were having a difficult time digesting their split acquisition of Conrail. The STB feared a BNSF-CN merger might cause more heartache.

· In the meantime, another consequential merger of the late 1990s—Canadian National’s acquisition of the Illinois Central—set the industry on a new inward-looking path. The IC’s Hunter Harrison, eventually rising to CEO at CN, spent the 2000s not focused on expanding through consolidation, but instead shrinking to lift profit margins. His strategy, called Precision Scheduled Railroading (PSR), proved enormously successful in financial terms. Harrison would later implement PSR at Canadian Pacific and again at CSX. UP itself adopted the strategy in 2018, hiring a new operating chief named Jim Vena—a Harrison protege—to help implement it. Unions hated PSR. Shippers hated PSR. But Wall Street loved it. Other railroads including Norfolk Southern and even to an extent BNSF were pressured to follow.

· At some point though, there wasn’t much more to cut. Class I railroad profit margins, having reached extremely high levels, stopped growing. In fact, they even slipped a bit. Consolidation again began to enter people’s minds. CPKC, in 2021, outbid CN to acquire Kansas City Southern, creating CPKC. Notwithstanding some current operational messiness tied to IT issues, the CPKC merger has delivered reliable service, strong profits, lots of revenue synergies, and new growth opportunities.

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.