courtesy: Steel Wheels Photography

Inside This Issue

· Mark Attack: NS Gains Steam with George in Charge

· Distress? Yes, but For Now Success: RRs Hold Firm Amid Tariff Fears

· Blowing the Fiscal Whistle: Investors Sweat About Washington’s Debt

· Pocket Watch: RRs Downplay Impact of Present Port Plunge

· CP Worry-Free: RR Says It’s Finding Ways to Win

· CN’s Prince Charming: RR Super-Bullish on Future Rupert Throughput

· Grain Elevator: Ag Freight a Big Reason for RR Growth This Year

· Eastern Block: Low Export Coal Prices Weigh on CSX, NS

· Container Box Paradox: IM Volumes Rising but Pricing Stays Weak

Track Talk

“What we really are focused on at NS is kind of coming back to our core strategy, delivering a great service product for our customers that they can count on and they can trust, which helps us grow, brings more volume onto the network, brings volume that should be on rail, should be on NS back to us. Enhancing our productivity and cost profile and doing it all safely.”

-Norfolk Southern CFO Jason Zampi

The Latest

· For a few days last week, tariffs stepped aside from the economic spotlight. Instead, the top concern was Washington’s fiscal health. The House of Representatives passed a large new tax law that would—subject to Senate modification and approval—further raise the federal budget deficit, according to Congress’s own economists. This convinced Moody’s, one of three big firms monitoring credit risk, to remove Uncle Sam’s triple AAA rating (Standard & Poor’s already did so 14 years ago; Fitch did the same two years ago). More importantly, the advancing tax law convinced investors to flee U.S. Treasury debt, driving up Uncle Sam’s longer-term borrowing rates. 30-year Treasury yields are now back above 5% for the first time since 2023. Federal debt (excluding money it owes to itself) is currently about equal to total U.S. GDP ($26 trillion). Last year, the federal government spent $6.8 trillion but collected just $4.9 trillion, meaning a deficit of $1.9 trillion.

· By week’s end, however, tariffs were back on center stage. In a social media post on Friday, President Trump threatened a 50% tariff on imports from the European Union starting next week (June 1st). Just a negotiating ploy? More bark than bite? Another prelude to a last-minute temporary postponement? Either way, the mere threat is disruptive to major U.S. exporters like Boeing, which scrambled to prepare for retaliatory E.U. tariffs on its aircraft. Some of the plane maker’s largest customers are European airlines like Ireland’s Ryanair and Germany’s Lufthansa. Ryanair, for its part, said last week it would be Boeing’s responsibility to cover any tariff costs. In the meantime, Chinese airlines are racing to import as many Boeing jets as possible before a 90-day tariff truce expires in August. [update: Trump wrote on Sunday that the E.U. tariffs would be delayed to July 9th].

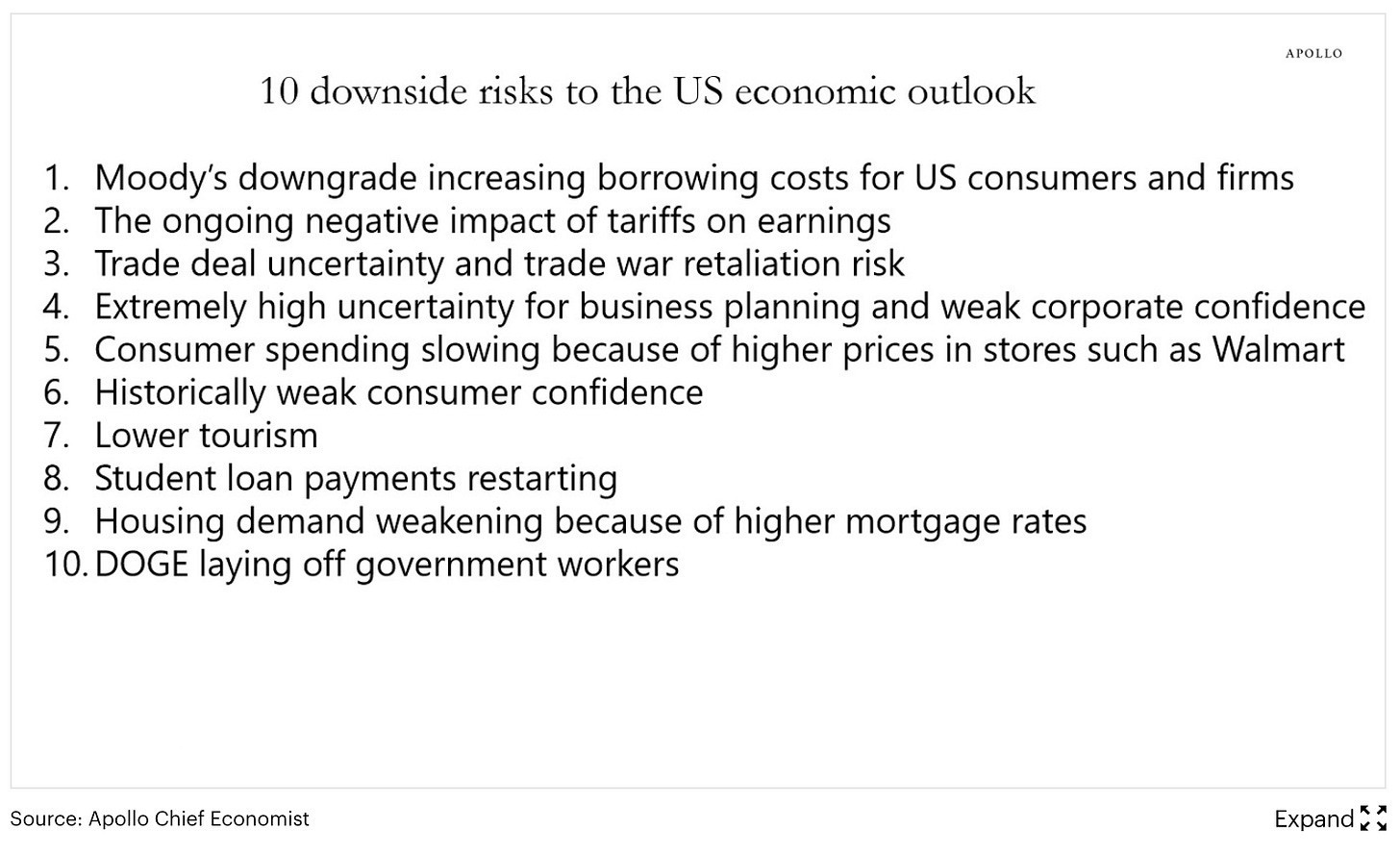

· Boeing is just one example of a U.S. company already disrupted by tariff uncertainty. President Trump, incidentally, also threatened Apple last week, with 25% tariffs on iPhones. He previously gave Apple a temporary reprieve from his 145% China tariff. O.K., but how about North America’s railroads? They’re still uneasy about tariffs for sure, especially their potential to significantly slow the economy. But that doesn’t seem to be happening yet. At an investor event hosted by Wolfe Research last week, Class I executives showed more smiles than frowns, pointing to impressive productivity gains, growing traffic volumes, smoothly-running operations, and strong demand from important sectors like agriculture and even coal. Railroads still expect to win lots of new business in the years ahead, via share shift (from the highways), for example, and new factories sprouting along their networks. Tariffs could even lead to some new domestic U.S. freight. Railroads are also happy about Washington’s more business-friendly regulatory approach. Tax cuts could boost the economy. So could lower oil prices. On the other hand, here are some risks to the economy, as listed by Apollo’s Torsten Slok:

· How is tariff drama impacting intermodal markets? Here too, railroads seem relaxed. The sharp downturn in container imports now hitting U.S. west coast ports isn’t affecting railroad volumes much yet. And things might stay that way, with port activity poised to jump again in tandem with the recent China tariff truce. Railroads, all the while, appear ready to handle what comes. Intermodal expert Larry Gross noted in a LinkedIn post that “average intermodal train speeds have been rising steadily over the past five weeks… Clearly, adequate resources are available to move trains.”

· Investors, however, remain concerned about the tariff threat, as last week’s drop in railroad stock prices made clear. Uncertainty still looms large, about the eventual

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.