Inside This Issue

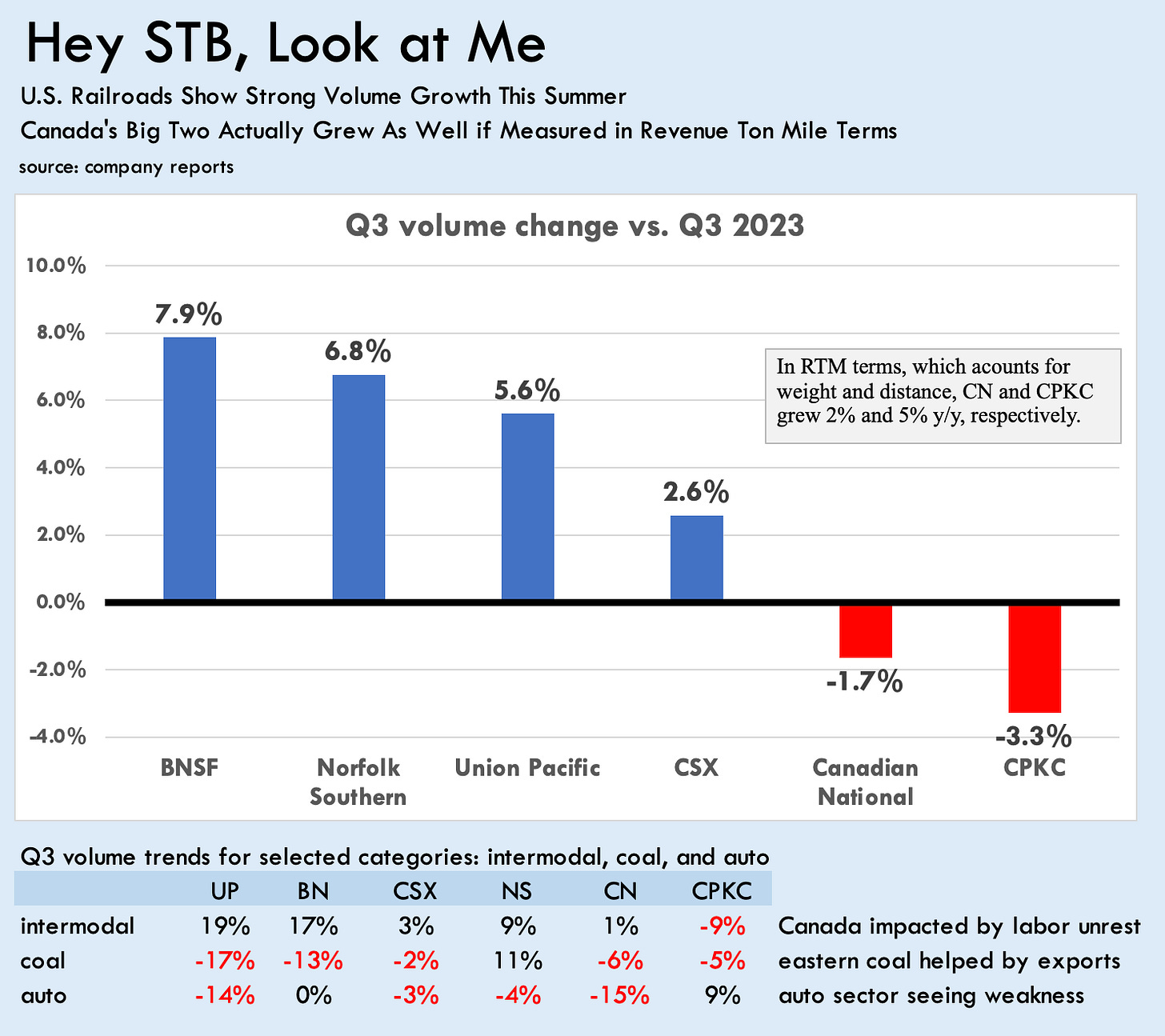

· Hey STB, Look at Me: U.S. RRs Showing Strong Volume Growth

· Southern Comfort: NS Shows Big Financial Progress as O.R. Drops

· Ra Ra in Omaha: UP Delivers Strong Results Despite Coal’s Toll

· That Wasn’t So Bad: Solid Q3 for Canada’s Class Is Despite Setbacks

· Hard Drive: Auto Market Joins Coal and Steel as RR Trouble Spot

· Load Warriors: Energy, Ag, Chem Were Q3’s All-Star Markets

· California Teeming: RRs Enjoy Import Surge but IM Rates Still Down

· Election Affliction? Is the Presidential Contest Slowing the Economy?

Track Talk

“With just over two months left in the year, the majority of the 2024 story has been written, and it’s been a good one.”

- Union Pacific CFO Jennifer Hamann

The Latest

· Union Pacific, Norfolk Southern, Canadian National, and CPKC all reported their Q3 earnings last week, joining CSX which reported a week earlier. For all five (BNSF has yet to report), there was a lot to like, never mind that all lost market value (see the stock price figures below). The three U.S. Class Is improved their operating ratios from a year ago, while the two from Canada saw just a modest deterioration, despite a summer full of disruptions (a work stoppage and a major wildfire). The U.S. Big Four, including BNSF, delivered robust volume growth during the quarter, advancing the goals they presented at last month’s STB growth hearings. Western coal volumes plunged. Auto and steel markets are troubled. Hurricane disruptions didn’t help. Neither did ongoing softness in America’s industrial sector. But conversely, intermodal traffic spiked as west coast ports inhaled a tsunami of containerized imports. At the same time, U.S. railroads are enjoying healthy revenue and volume trends in important sectors like chemical, ag, and energy transport.

· In Canada too, several critical segments are trending in the right direction. Canada’s grain harvest looks very positive. The country’s outsized energy and chemicals sector is likewise producing healthy loads of rail freight. Railroads across North America are hoping for more help macroeconomically in 2025, perhaps as lower interest rates stimulate housing construction, auto sales, and factory investment. Washington’s heavy spending on transportation, industrial, and energy infrastructure continues to support rail-heavy projects, though some of these projects are taking longer than expected amid labor shortages, slow permitting, and other constraints (see below). Railroads likewise hope that industrial investment and durable goods spending revive after next week’s presidential election, which some in Corporate America say is momentarily slowing economic activity.

· Another theme from the Q3 reports: The sharp fall in diesel fuel prices. It’s a godsend for most transportation companies, from airlines to ocean liners to trucking firms. For railroads though, it does mean revenue from surcharges will drop in tandem, and the revenue declines in Q4 might exceed the cost declines. Another area of revenue pressure remains the domestic intermodal market, where trucking overcapacity just won’t seem to correct. But these negatives aside, North America’s Class Is are more broadly faring well in their efforts to increase pricing. In fact, most are confident they can do so to a degree that outpaces overall cost inflation. Keep reading for more takeaways from Q3 earnings season.

Other Developments

· On the industry conference circuit, railroads and their stakeholders presented at a Pacific Northwest shippers event in Seattle (more on that in next week’s issue). Also coming up are earnings reports from BNSF (as disclosed by its owner Berkshire Hathaway) and Mexico’s Ferromex (as disclosed by its owner Grupo Mexico).

· Union Pacific gave a presentation on transporting renewable fuels, an important potential growth engine. Norfolk Southern is creating a customer advisory board. Its new CEO Mark George, meanwhile, appeared on CNBC after presenting Q3 earnings, highlighting the company’s achievements.

The Economy

· Just one more week until the contentious U.S. presidential election, which some companies blame for a momentary lull in economic activity. Southwest Airlines, for one, sees an “election trough” in flight bookings. To be clear though, others like the software firm Tyler Technologies disagree: “We’re actually not seeing any slowdowns or hesitations due to the election.”

· In any case, much of the economy looks healthy for the Thanksgiving period and beyond, with S&P Global’s survey of purchasing managers signaling “a further solid rise in business activity to mark a robust start to the fourth quarter.” But railroads… don’t get too excited. S&P also said, “Growth was driven solely by the service sector… manufacturing output contracted for a third month running.” The purchasing managers did for the record cite some “uncertainty ahead of the presidential election.”

· Underlying this macroeconomic strength, more than anything else, is the U.S.

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.