Photography by Frederick Manfred Simon © www.steelwheels.photography

Inside This Issue

· Carless Whispers: UAW Strike Endures, Railroads Starting to Feel It

· Come In, We’re Open: Federal Gov’t Avoids a Shutdown… For Now

· Less Bread Abroad: Why Are U.S. Food Exports Plummeting?

· Gassing Fancy: For Railroads, a Pleasant Surprise as Gas Prices Rise

· More Time for the Family: BNSF Secures Another New Labor Deal

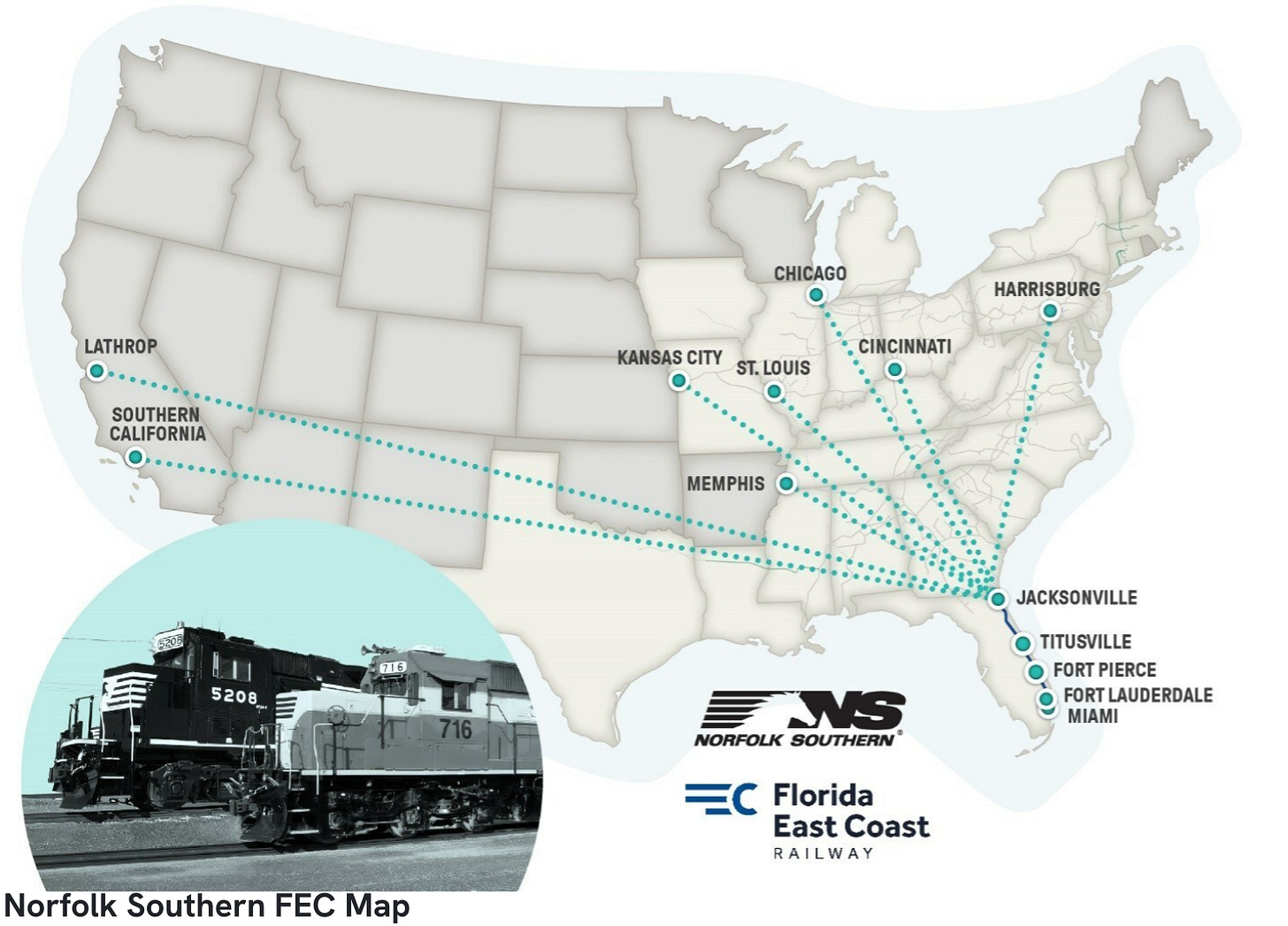

· Florida Flow: NS, FEC Team to Ease Sunshine State Shipping

· From Tracks to Trucks: Railroads Contemplate their Intermodal Woes

Track Talk

“We know that we got every inch of quality-of-life improvements out of this agreement. It’s our belief that our BNSF members are going to have more time off with their loved ones. They won’t get called right before their day off, forcing them to continuously cancel and change their family’s plans, and when they have this time away from the rail, they’ll have a little more in their pockets on top of it. All the way around, this is a good development for our men and women, and we couldn’t be more excited for them.”

-combined statement from SMART-TD union leaders Joe Lopez, Chad Adams, and Jamie Modesitt, after securing new contract benefits from BNSF

Read American Places, a book with deep insights into the most important trends and developments throughout the U.S. economy -Jay Shabat, Publisher, Railroad Weekly

The Latest

· The United Auto Workers strike is now entering its third week. And things are mostly getting worse, not better. The strikes have spread to more production facilities, putting more auto rail freight at risk. As a reminder, Norfolk Southern’s Alan Shaw, speaking at an FTR event just before the strike started, estimated that a strike of roughly 7-to-10 days would have no meaningful impact. But we’re beyond that point now, and NS and its peers are likely starting to lose auto business—business that was delivering healthy growth at a time when most other freight categories were shrinking. As Railroad Weekly showed in a chart last week, NS gets about 9% of its total revenues from auto shipments, though that figure is likely understated because auto production also drives shipments of other freight like steel and plastics (Union Pacific for the record led the way with 11% of its first half revenues from auto shipments). Of course, the autoworker strike is targeting just GM, Ford, and Stellantis/Chrysler. It doesn’t affect the many foreign-owned auto plants that NS and other railroads serve (think Volkswagen’s giant plant near Chattanooga or Toyota’s facility between Lexington and Cincinnati). Detroit’s Big Three, Shaw said at the FTR event, collectively account for just 30% to 40% of NS’s total auto volumes. Incidentally, he also said that roughly one-third of the $70b now being spent on new electric vehicle and battery factories is happening on the NS network.

U.S. Auto Factories

source: Mapporn

· Speaking of the NS network, a new partnership with the Florida East Coast Railway (FEC) aims to provide more intermodal options for Florida shippers. NS already serves FEC’s Titusville and Miami terminals. The cooperation will now extend to its facilities in Fort Pierce and Fort Lauderdale, also located along Florida’s Atlantic coastline. That gives more flexibility and optionality for Florida companies shipping boxes to key NS distribution nodes across the country, namely Chicago, Cincinnati, Harrisburg, Kansas City, Memphis, and St. Louis. Service to California is now possible as well. To facilitate smooth transfers, the two railroads will establish a steel-wheel connection (i.e., no draying involved) in Jacksonville. The FEC, by the way, is controlled by Grupo Mexico, the largest shareholder in Ferromex.

· Regarding the new NS-FEC service, Ari Ashe of the Journal of Commerce remarked in a LinkedIn post that rates between Florida’s east coast and the midwest/mid-south tend to be “very truck competitive,” based on the Journal’s Intermodal Savings Index. Intermodal providers, he thus concludes, “might have to deal on price to get business.” He adds, “There is also a need to get more bi-directional business on these lanes.”

courtesy: NS and FEC

· Turning to back labor relations, BNSF landed another new union agreement, this time with the SMART-TD, which represents its conductors and various ground workers. In May, the railroad reached a deal with SMART-TD on sick pay. This new deal—subject to member ratification—concerns work schedules and other quality-of-life benefits that BNSF hopes will improve morale and reduce turnover (some employees used to joke that schedules were so rough that BNSF stood for “Better Not Start a Family”). The union said one of its goals was to “bring predictable guaranteed time off for our members regardless of their assignment or board. We believe we achieved these goals and significantly more.”

· The Biden administration last week allocated $1.4b in federal money (from the Infrastructure Investment and Jobs Act) to 70 rail-related projects. One will help Amtrak restart long-dormant Gulf Coast passenger service between New Orleans and Mobile. Another will help fund battery-electric locomotives for CSX to use at its Curtis Bay export terminal in Baltimore. Still other projects will help improve track conditions, build new rail bridges, enhance safety, lower emissions, and so on. Click here for a full list of federally-funded rail infrastructure projects across the country. Separately, the FRA will give $5m to the University of Illinois to establish a “National Rail Center of Excellence.” It will help with “advancing research and expansion that enhances the safety, efficiency, and reliability of both passenger and freight rail transportation.”

· Tensions over the STB’s new reciprocal switching proposals are starting to surface. The railroads, represented by the AAR, feel the 45-day period for submitting comments is too short, i.e., “insufficient to allow interested parties to analyze and provide meaningful comment.” So, railroads want another three months. Not a good idea, says the Freight Rail Customer Alliance. “Rather than seek delay, the railroads should be grateful that the Board is not adopting the more ambitious measures that it previously proposed in EP 711.” [EP 711 refers to the more aggressive reciprocal switching regulations the STB recommended in 2016].”

· In other developments, Katie Farmer and Alan Shaw, the chiefs of BNSF and NS, respectively, addressed a southwest rail shipper event in San Diego. NS’s operating chief Paul Duncan talked about human resource issues like hiring and training on a podcast with Railway Age editor-in-chief William C. Vantuono. Union Pacific’s marketing chief Kenny Rocker, in one of his periodic “Status of the Railroad” updates for customers, shared the latest on staffing levels, operational metrics, and product offerings. UP’s car velocity, he said, currently stands at 207 miles per day, up from 202 in the second quarter and just 196 in the first quarter (and an ugly 177 at its low point in the spring of 2022). Also last week at UP, the company hosted its annual event for shortline and port partners.

The Economy

· In a pleasant surprise, there won’t be a U.S. federal government shutdown (for the record, some 350 FRA employees would have been furloughed, according to Politico). That means normal government business can continue, at least for another month and a half. This includes the publication of vital economic data used by the Federal Reserve and Corporate America, like the BEA’s monthly report on personal income, featuring the closely-watched PCE inflation rate. The August update was published last week, showing PCE up 3.5% y/y (the BLS’s CPI figure was 3.7%). With inflation still running ahead of its 2% target, the Fed might not be finished raising interest rates. It will make its next decision the day after Halloween (Nov. 1st).

· Another report last week, this one from the Census, showed U.S. food exports down 20% y/y in August. That reflects a lot less grain getting shipped abroad, which has implications for railroads (which move the grain from farms to ports). One reason for the decline is more competition from other grain-producing nations like Brazil. Drought, furthermore, reduced production in some areas of the U.S. Looking ahead, U.S. grain exports will likely stay subdued as domestic demand increases, driven by efforts to produce fuel from crops. That should in fact bring more business to railroads, which can transport both the grains to the biofuel plants, and then the biofuel to end users.

· Note from the chart below that railroad stock prices have been taking a hit in recent weeks. That’s consistent with a broader decline in the stock market, reflecting investor concerns about things like interest rates, the resilience of consumer spending, the resumption of student loan repayments, the impact of the autoworker strike, etc. The economy certainly has some tailwinds too of course, including the fact that fiscal policy is expansive, perhaps neutralizing the impact of the Fed’s restrictive monetary policy. The job market is still healthy too. So are even certain parts of the manufacturing sector like aircraft building (nondefense aircraft and parts shipments are up about 40% y/y).

· Note also from the chart that natural gas prices spiked last week, which is good news for coal producers (coal and gas compete as inputs to produce electricity). Railroads, remember, still count coal as their number one carload commodity by volume, despite being less important than it was historically. For the record, U.S. railroads carried a third fewer carloads of coal in 2022 than they did in 2006. But again, it’s still a major source of their business.

· A few other economic data points from last week: Updated BEA GDP figures show the U.S. economy grew an annualized 2.1% in the second quarter. The National Association of Realtors said pending home sales dropped 7% from July to August, perhaps no surprise with average 30-year mortgage rates now exceeding 7%. Pending home sales are down 19% y/y. You would think that means housing prices are falling. But they’re not. The Federal Housing Finance Agency said prices in July were actually up 5% y/y. Clearly, America has a housing supply problem.

· Turning to Canada, where GDP was stagnant in the second quarter, government data show surging population growth. The country added more than 1m new residents last year, many of them immigrants and students. In June, the population exceeded 40m for the first time. Growth rates are now the highest they’ve been since 1957.

Highlights from Last Week’s JOC Intermodal Event in Chicago

· The Journal of Commerce held a conference on inland distribution last week, focused on the troubled intermodal freight market. Hosted in Chicago, the event

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.