Inside This Issue

· Pocket of Pain at the Ports: For IM Biz, Tariff Impact Starts to Show

· How Much Pain for RRs? There Might Be Relief; Pocket Might Just be Brief

· The Real RR Nightmare: If Trade Suppression Sparks Recession

· Highway Robbery: BN/JB/Ferromex Team to Win Mexico Truck Traffic

· How Do You Say Recession in Spanish? Mexico’s Economy No Es Bueno

· Joe’s Foes: CSX Chief Laments High Interest Rates, Trade Uncertainty

· Support from the Court: SCOTUS Rules in Favor of Utah Rail Project

· Dimon Doom: King of Wall Street Says a Bond Crisis Looms

· Deal Reveal: Arbitrator in CPKC Labor Dispute Makes His Decision

Read American Places, a book with deep insights into the most important trends and developments throughout the U.S. economy -Jay Shabat, Publisher, Railroad Weekly

Track Talk

“After moving the most containerized cargo of any American port in the first quarter of 2025, we are now anticipating a more than 10% drop-off in imports in May—and the effects will be felt beyond the docks. Soon, consumers could find fewer choices and higher prices on store shelves, and the job market could see impacts, given the continuing uncertainty.”

- Port of Long Beach CEO Mario Cordero (May 15th)

The Latest

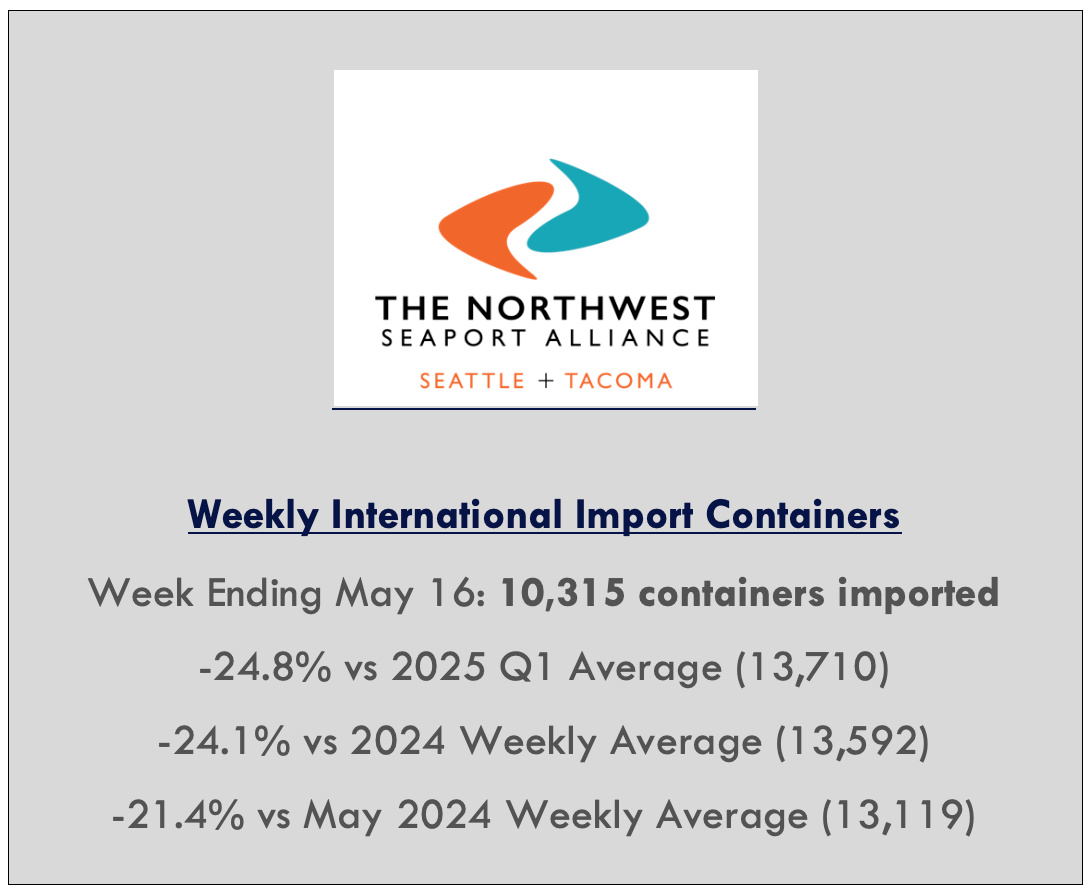

· That intermodal “air pocket” everyone was talking about? Finally, you can see it in the numbers. The AAR’s U.S. freight rail figures for the week ending May 24th show a 2% y/y decline in intermodal traffic. That compares to a slight increase a week earlier, a 5% increase in the week before that, and a 9% increase in the week before that. For about a month, from mid-April to mid-May, the U.S. imposed an extreme 145% tariff on most Chinese imports, sharply curtailing new factory orders. That resulted in fewer transpacific container shipments—and ultimately a few weeks later—fewer containers showing up at ports like Los Angeles, Long Beach, and Seattle/Tacoma.

· However, when the China tariffs were momentarily lowered to 30% on May 14th, U.S. importers placed a rash of new orders, hoping to have them shipped across the Pacific before rates potentially rise again. The current rates are in effect until mid-August. It’s anyone’s guess what they’ll be thereafter. In any case, that post-May 14th order surge should cause port volumes to jump again in a few weeks.

· The railroad volume declines were concentrated on Union Pacific and especially BNSF, the two Class Is serving America’s west coast ports. Norfolk Southern and CSX, without direct exposure to west coast ports, actually saw intermodal volumes increase a bit in that same week. They do carry west-coast-originating containers for sure, via gateways like Chicago. But they’re exposure is less.

· Note that western ports like Los Angeles get a smaller percentage of their imported container freight from China than they did in years past, as U.S. companies diversified some of their sourcing, in some cases to factories within the U.S. (or in neighboring Mexico) but often to other Asian countries like Vietnam. Of course, Vietnamese imports are now subject to a not-insignificant 10% tariff, with that rate set to jump nearly fivefold after mid-July.

Port of L.A. Data for Calendar Year (CY) 2024:

courtesy: Port of Los Angeles

· The Northwest Seaport Alliance (NWSA), which runs the twin ports of Seattle and Tacoma, started seeing a significant slowdown earlier in May. “While March and April saw higher volumes y/y compared to 2024, a significant shift occurred in May. The week of May 5th through 9th was the ‘first week demonstrating those concerns that we’ve been highlighting since the tariffs were implemented’. Compared to the week prior, the port saw a 30% drop in international import volumes, which is also down 23% compared to the weekly average for the whole year.”

· To be clear, total North American railroad exposure to Chinese imports is pretty modest. CSX estimates the figure to be about 10% of total revenues. The number will naturally be somewhat higher for the western railroads. What worries the Class Is much more than a Chinese import collapse is an economic downturn caused by a Chinese import collapse. Or put another way, if goods get more expensive, and consumers slow their spending, and companies earn lower profits… that’s the real nightmare scenario.

In Other News…

· More tariff drama last week? Better believe it. On Wednesday, a U.S. federal trade court ruled that many of President Trump’s tariffs—including his worldwide “reciprocal” rates—aren’t legal. One day later though, an appeals court said they can stay—for now. The matter could wind up at the Supreme Court. Still later in the week, the President said steel tariffs would jump from 25% to 50% on June 4th. He separately accused China of violating the temporary tariff truce agreement signed earlier this month, chilling prospects for a long-term agreement. Treasury Secretary Scott Bessent added to the pessimism, calling trade talks with China “a bit stalled.” The China tariff truce currently runs through mid-August.

courtesy: Joseph Politano’s Apricitas newsletter

· CSX chief Joe Hinrichs, in a recent appearance on CNBC’s Jim Cramer show, named two things he wishes for right now: 1) lower interest rates, which would stimulate housing, auto, and construction freight; and 2) less economic uncertainty, especially with respect to tariffs. CSX has seen a modest slowdown in some areas like plastics and paper/packaging. But overall, demand has stayed resilient across most categories, with the future still looking bright as hundreds of new factories and warehouses develop along its network. Hinrichs thinks the new tax bill now making its way through Congress could further stimulate business development, specifically a provision to change the way taxes are assessed on depreciation. Of course, CSX would be moving more freight currently had roughly a fourth of its north-south network not suffered severe hurricane damage—that and the Baltimore tunnel project that’s disrupting normal operations. As for coal, he repeated the two big antithetical themes discussed in the railroad’s Q1 earnings call: Volumes are good, export pricing is bad.

· BNSF and Mexico’s GMXT (which owns Ferromex) will team with J.B. Hunt to offer a new intermodal service. It’s an extension of the BN-J.B. Hunt Quantum product already on offer but in this case for time-sensitive freight out of Mexico. It’s called, appropriately enough, “Quantum de México.” And it’s likewise aimed at “just-in-time” freight currently moving by trucks on highways. All Quantum offerings get an on-time delivery rate that exceeds 95%. And it’s up to one day faster than standard intermodal service. It’s thus priced at a premium to standard service. Last year, the same three companies jointly launched standard intermodal service to Mexico, via the border crossing at Eagle Pass, Texas. Clearly, their developing cooperation reflects a desire to capitalize on Mexico’s nearshoring potential. U.S. tariffs on Mexico, however, threaten that potential.

statement from BNSF, Grupo Mexico (Ferromex), and J.B. Hunt:

· Union Pacific stands to win some new business. The U.S. Supreme Court ruled in favor of a railroad project designed to move oil from northeastern Utah to UP’s mainline network, connecting in the town of Kyune, on the way to Denver. The “Uinta Basin Railway” would run for 88 miles, the start of a routing that would ultimately send Utah’s oil to the Gulf Coast for refining. The STB approved the project in 2021, but it was held up by environmental lawsuits. Even after last week’s ruling though, it still needs some additional permits and approvals before construction can start. You can read the Supreme Court’s ruling here. The STB was happy, saying it “reigns in the scope of environmental reviews that are unnecessarily hindering and potentially preventing infrastructure construction throughout the country.”

· The STB separately put an end to its earlier “Final Offer Rate Review” (FORR). It was adopted in late 2022 to help resolve pricing disputes between railroads and shippers. But a federal court ruled against it. The AAR, representing railroads, strongly opposed the rule.

· Big news in the railcar leasing sector: Wells Fargo is selling its rail leasing business to Chicago-based GATX and Canada’s Brookfield Infrastructure, the owner of the Genesee & Wyoming shortline empire. The transaction involves 105k railcars, though Brookfield is also buying another 23k from Wells, along with more than 400 locomotives (GATX will manage these assets). More than half of today’s North American railcar fleet is owned by lessors, led by firms like GATX, Trinity, Greenbrier, CIT, and Union Tank Car (the latter owned, like BNSF, by Berkshire Hathaway). Shippers and railroads often prefer to lease rather than own their cars, in part for the operating flexibility. This preference is especially high for tank cars, whose owners must adhere to complex regulatory standards. In fact, nearly 60% of the railcars owned by GATX are tankers. The Wells Fargo fleet, however, is much more diversified, with tankers accounting for just 5%, as you can see from the chart below. Also note: The deal nearly doubles the size of the GATX fleet, from 110k cars to 215k. “What the Wells Fargo integration will do for us, is it will give us a lot more balance,” said a GATX executive. Note that Wells Fargo itself got into the railcar leasing business in 2015, when it purchased GE’s portfolio. The sale to GATX and Brookfield, subject to regulatory approval, should close in early 2026.

courtesy: GATX investor presentation

· CPKC finally has new contract terms—following an arbitrator’s ruling—with its engineers and conductors, represented by the Teamsters Canada Rail Conference (TCRC). They’ll have a new four-year deal retroactively starting last year and running through the end of 2027. Wages will increase 3% annually. Last year, remember, Canada’s federal government ended a TCRC work stoppage by ordering an arbitrated settlement. It did the same for Canadian National, which received its arbitration ruling in April.

The Economy

· U.S. Treasury yields dropped last week, following alarm a week earlier, when the 30-year rate rose above the 5% mark. There’s a narrative building steam across Wall

Keep reading with a 7-day free trial

Subscribe to Railroad Weekly to keep reading this post and get 7 days of free access to the full post archives.